Hello, I’m Alpesh Patel,

Award-winning investor...

CEO...

Hedge fund manager...

World-renowned trading coach...

And author of 18 books on investing, including the international bestseller Mind of a Trader.

You may know me from my regular appearances on Bloomberg, CNBC, the BBC and others...

I’m sought-after, quite frankly, because my track record is red-hot.

In fact, last year I helped my loyal followers close out a double- or triple-digit win every 23 days on average...

With top-performing gains of...

- 119% on NOW in 58 days

- 107% on ADBE in 71 days

- 100% on MOH in 8 days

- 123% on DOV in 63 days

- 77% on PERI in 125 days

- And more!

Our average hold time across all our recommended positions was 133 days.

And here in 2024... we booked a 250% winner in just THREE DAYS.

Some people go five, 10, even 15 years to see a 100% gain on a stock.

We just proved it was possible to turn $50,000 into $175,000 in 72 hours.

Now, not all our trades are home runs like this, and there’s always going to be losing trades - with my or any other approach. But what I’ve shown, again and again over the years, is that it’s possible to achieve great things in the markets when you have a system that is proven to work.

And I’m inviting you to take an exclusive look “under the hood” at mine today.

At its heart is a tool that’s going to seem so simple, you’ll wonder why you never heard of it before.

In fact, I bet you’ll be wondering why this isn’t shown to every new investor who is faced with more than 10,000 publicly traded companies and must determine which is the best for their portfolio.

It all comes down to just five simple letters...

Five letters that have helped Goldman Sachs and other major banks offer a HUGE advantage to their top clients.

We’re not talking about the top 1%, either. But rather the top 0.01%! Clients with at least $10 million to invest.

And what does that $10 million buy you? Well, like most things in life, it gets you privileged access to a whole lot more than what the average person gets.

Goldman’s research found that these five letters – or rather, the tool they represent – are capable of filtering through those thousands upon thousands of publicly traded companies...

Drilling down to the absolute best of the best...

The top quartile...

And isolate the companies that beat the market by more than 550%!

Did you get that?

Not 5%.

Not 50%...

FIVE HUNDRED AND FIFTY PERCENT.

You’ve heard the phrase, “The rich get richer.” Well... this is why!

But I say enough of that rubbish...

Today I’m blowing the lid off the vault and showing you how to access this powerful tool for yourself.

I have zero doubt that it will have a significant impact on your success as an investor...

And help you beat the markets by not just a few points... but hundreds of times over.

For me, it’s completely changed the way I look at stocks.

And remember, I’ve spent the past few decades running a hedge fund that manages hundreds of millions of dollars.

It would be no exaggeration to say that this tool has supercharged my trading. It’s been making the rich richer for 28 years.

Francesco Curto, the author of Valuing and Investing in Equities, wrote...

“Annual returns from this investment approach demand everyone’s attention.”

But as I said... unless you’ve been among the top 0.01% clientele at America’s largest banks, it’s never been made available to YOU...

Until now.

This may be the ONLY chance you have – in your entire life – to learn about this powerful tool... a genuine game-changer for any investor...

Let alone get special access to it!

So I want you to grab a piece of scratch paper and a pen. Or you can use the Notes app on your phone or tablet. Just be prepared to write down five letters.

Just five letters, I’m serious.

Even if you don’t remember anything else that I’m about to show you, you’ll want to recall those five simple letters. And don’t email me later saying, “Alpesh, what were those five letters again?” Because I just warned you, didn’t I?

Ready?

Okay, good. Get excited. Because over the next few minutes, I’ll show you:

- How this tool for the elite works and why it’s been so effective

- The odd way it was first introduced to me (some shameless self-promotion was involved...)

- And details on the top three stocks it’s pointing me to RIGHT NOW.

Now, I imagine out of everything I’ve mentioned, you found that last bit most exciting. And you should. Because the three stocks I’m going to tell you about – which I just pinpointed with the help of this special tool – are each positioned to double in the next 100 days.

In fact, I think one of these plays has the potential to be stock of the year.

It’s providing an essential service that, frankly, modern life can’t survive without. And yet, while business is booming and earnings are growing at a rate of more than 50% per year... this crucial stock is somehow deeply undervalued.

That’s GREAT news for us.

And most important of all... my system says it’s a SCREAMING “Buy!” right now.

But that’s just one of the stocks this tool is pointing me to right now...

Like I said, I think any of these three have the potential to double investors’ money – and soon!

If the performance of this tool is any indication – and I believe that it is – these three new plays should greatly outperform the broad markets...

By hundreds of percentage points!

Remember, Goldman Sachs researchers found that top stocks pinpointed by this tool beat the market by more than 550%.

Imagine what trouncing the indexes by that much could do for your portfolio in 2024.

Now imagine doing that year after year after year!

That’s why I’m so excited to share all of this with you today. And I hope you’re excited to receive this critical information.

Because the truth is... this is an important time for American investors.

A Proven Strategy... for Unprecedented Times

Don’t get me wrong. If you’ve had money in the markets, you should have done well these past five years.

But the ride has been bumpy to say the least.

My friends, this goes beyond cyclical volatility. It’s unprecedented!

It all started when the coronavirus pandemic wreaked havoc on the global economy. (As if you could forget.) The consumer bailouts that followed sent the cost of everyday goods soaring higher – and faster – than they have in decades.

And when the U.S. Federal Reserve stepped in to try to fix the situation through rate increases – with nearly a dozen hikes between March 2022 and December 2023 – it brought many popular stocks to their knees.

But we remained optimistic and stuck to our plan.

And sure enough, the markets came roaring back to new heights.

It shows you that great investing isn’t about trying to predict where the markets will be... it’s about using a proven system to identify the best stocks that will win in the long run.

Which is what makes the tool I’m going to share with you today so valuable.

Transforming Lives – One Winning Play at a Time

Listen, it’s more important than ever for you to get the right guidance in the markets.

And with more than 10,000 potential investments to choose from on any given day, you’ve got to follow someone who knows how to separate the wheat from the chaff.

Thankfully for the many thousands of subscribers who’ve chosen to follow me... that’s an area where I’ve excelled.

Peter Cruddas, billionaire CEO of CMC Markets, was once kind enough to say this about me...

“Alpesh’s insight to the markets and trading are a must-read for traders of all levels, including beginners – there is something for everyone.”

I’m not sharing this quote from Peter to brag. I just want to make my background clearer to those who don’t know me.

For years, I’ve helped put those who’ve followed my recommendations into very fortunate positions.

Some of the winning investments I’ve hand-picked over my career include...

Water Intelligence, which went up 212% within a year...

Capri Holdings, which went up 331% in 11 months...

And Viacom, which shot up 700%-plus in a year.

Calls like these have the power to transform peoples’ lives.

I’ve been fortunate to see the results firsthand. Not just as a hedge fund manager and advisor. But with my own family... and in my own life, from early on.

And I do mean early.

Here’s another quote – from when I was profiled by The Independent...

“Alpesh was playing the market when most of his contemporaries were still swapping football stickers.”

It’s true. I bought my first stock when I was just 12 years old!

I borrowed 100 pounds from my aunt and sent in a check to invest in the company British Telecom.

I mailed a check!

That’s how long ago it was!

Now, I was proud of myself just for figuring out that bit. But just imagine my reaction when that investment quickly doubled. You can bet it made me very popular with relatives.

I got hooked on investing and never looked back.

It wasn’t the expected path in my family... but it’s something that captured my imagination as a way to change my family’s fortune forever.

Look, I grew up in Armley, a blue-collar part of Leeds, population 25,000.

My granddad was in the British army. My mum was a nurse. I was raised by my aunt, who was a single mother.

But at 12 years old, I saw how I could get a company like British Telecom to work for ME.

I wasn’t an employee of the business. I was the owner. I was a shareholder.

And that’s the position you want to be in.

I quickly understood that.

I wanted to be an investor so that I would be at the top of the food chain.

That way, I wouldn’t be stuck working for someone else, getting paid a fraction of the value that I was adding to the company.

So, the life of an entrepreneur and an investor had an immediate appeal to me.

Of course, I knew I would need to work hard if I was going to make it.

That’s why I earned degrees in philosophy, politics and economics from Oxford and in law from King’s College London.

I spent years as a barrister – which is a type of lawyer in the U.K. – advising banks, building societies and pension funds on financial services.

And, eventually, I started a successful hedge fund from scratch...

A hedge fund that The Economic Times named...

“one of the world’s best-performing hedge funds.”

Since then, I’ve made a fortune in the markets.

I’ve personally invested in some of the biggest winners of the past two decades, including...

- Square

- Microsoft

- TechTarget

- Amazon

- Globant

- PayPal

- Visa

- Mastercard.

And remember my dear aunt?

The one who loaned me the 100 pounds that got me started?

This is us earlier this year celebrating her birthday in the Maldives – on my dime, of course. I like to think I’ve maintained my status as her favorite nephew.

The point is... I’ve achieved the sort of success as an investor that I know others dream of. And how I did it is no secret.

Just the fact that I’m doing this broadcast should tell you that I’m always happy to share my system with interested investors.

Yes, it relies on the same powerful tool that Goldman Sachs and other big name banks reserve for their top clients.

But the underlying pieces have been equally important.

In fact...

Before we move forward, I’m going to quickly run you through the three core elements of my system.

Don’t worry, it’s all quite simple.

But I believe seeing how everything works at a base level will help you understand why my system, as a whole, performs so well for me and my subscribers.

You may want to take notes here as well.

One Simple Strategy With Virtually UNLIMITED Power

I first started using this strategy extensively in the early 2000s.

It’s got a great, long pedigree – just like yours truly.

I knew right away that I had something when, in 2004, it pointed me to two big winners: Apple and BlackBerry.

To illustrate the success of those plays, all I need to do is show you the two charts of those stocks that year...

Both stocks nearly tripled... within just 12 months!

That’s very rare.

For example, in 2023... only three stocks in the entire Nasdaq and S&P 500 more than tripled.

Just three!

And if you can remember all the way back to 2004... Apple and BlackBerry were NOT beloved stocks in those days.

The release of the first iPhone was still three years away. And BlackBerry was basically a penny stock.

There was little buzz surrounding either company. But that’s one of the things that’s so great about my proprietary system... it helps me identify companies that WILL have buzz in the future.

You see...

- It doesn’t matter if the market doesn’t love a certain stock

- It doesn’t matter if the institutions don’t love it

- It doesn’t matter if the media doesn’t love it.

If my system, based on crunching the numbers, says a stock is a “Buy,” that’s all that matters.

And that’s exactly what happened with Apple and BlackBerry.

Sure, people thought we were mad for owning them.

Apple’s global market share for PCs sank to an all-time low of just 3% in 2004.

And BlackBerry’s future was clouded over a patent dispute.

But I trusted in my system... the data and the numbers we were crunching. So when it indicated “Buy”...

We did.

And this was right when I first launched my hedge fund. So a lot was riding on this.

Apple wound up as the S&P’s stock of the year in 2004. It went on to capture 70% of the market for all downloaded music... thanks to its introduction of iTunes.

And BlackBerry hit all-time highs that year as well.

Investors without a system... who listened to the mainstream advice... well, they got the same results as their peers. The S&P 500 had an average annual return of 10.74% in 2004.

Meanwhile, thanks to my system – and my success with stocks like Apple and Blackberry – that was the year The Economic Times honored my hedge fund as one of the top-performing funds in the world... and dubbed me “The Rainmaker.”

From there... we were off to the races.

And like I said, the secret to my winning system isn’t based on some complex algorithm or software.

It’s very simple, really.

I focus on just three things: Growth. Value. Income.

Say it with me...

Growth.

Value.

Income.

Now, for most people... these would count as three separate approaches.

T. Rowe Price believed that targeting stocks with big growth numbers was the key to being a successful investor.

Benjamin Graham wrote the book on value... Value investors focus only on his theory.

And still others like Bill Gross, the bond king, believe that income is key.

So, a lot of investors believe you have to pick one of these strategies and stick with it.

Or gamble on the flavor of the month... In other words, try to determine which approach makes sense based on what the broad markets are doing now.

That’s a silly and, frankly, dangerous approach – especially if you’re a new or novice investor.

Listen... I’ve studied them all and I’ve tried them all.

And here’s what I’ve discovered.

Sure, you can succeed with one of these strategies.

But if you combine the power of all three, your performance goes off the charts.

I’ll explain.

It’s True... Investors CAN Have It All

Imagine being able to identify stocks that were seeing massive growth... were trading at the perfect value... AND could potentially deliver you incredible income...

You’d have it all.

Through my research as a Visiting Fellow at Oxford University, I discovered you can have all three.

Growth-Value-Income is the basis of my system.

I call it GVI for short.

And I’ve created proprietary formulas that go into targeting the best-ranked stocks based on their growth, value and income metrics.

It’s helped me target many big wins over the past six months, like...

- GigaCloud Technology (100%)

- General Dynamics (144%)

- F5 Inc. (78%)

- Ramaco Resources (103%)

- Autodesk (77%)

- And W.R. Berkley (250%).

That last play I mentioned – W.R. Berkley – more than tripled in just a matter of days.

One of my subscribers, Ted B., told me he pocketed $8,500 in less than a week. He said...

“Very good recommendation.”

And another, Kevin C., told me...

“Great call – now we’re spoiled... THANK YOU.”

I love it.

But no one needs to thank me.

Well, they can...

But it’s really my GVI system that makes pinpointing these types of opportunities possible.

And right now... my GVI system is actually pointing me to three new stocks that I’d like to share the details on.

As I teased at the beginning, I’m seeing a perfect GVI score for one of these plays, which indicates to me that it could be among the best-performing stocks of the year.

We’ll get to the details on those opportunities shortly...

And, equally important, the powerful tool that all but ensures we’re targeting companies with the potential to beat the market by 550% or more.

But first, let me break down what – exactly – I am looking for in terms of growth, value and income.

First, GROWTH...

GROWTH

Listen, there has never been a stock in the history of the markets that saw big revenue growth and didn’t eventually see the stock price rise as a result.

Take Amazon – one of the greatest growth stories of all time.

Over nearly two decades, the company has grown net sales each year, consistently, from less than $7 billion in 2004 to more than half a trillion dollars today.

By expanding its offerings to include cloud services, streaming subscriptions and online storefronts for third parties, Amazon has compounded its annual revenue growth...

And its share price over the decades certainly reflects that.

Amazon has grown at a compound annual growth rate of 23.2% – almost four times what the S&P 500 has done in the same time frame.

$10,000 invested in Amazon stock 20 years ago would be worth $645,262 today.

That’s a lifechanging sum for many people.

This is why it’s so critical that we target companies seeing significant and steady revenue growth.

In the long run, it’s a mathematical certainty...

Stocks will follow growth in revenues and growth in earnings.

Now on to VALUE.

VALUE

My system targets price relative to earnings. P/E ratio, as it’s called.

But it’s important to note... I measure value a bit differently from other value investors, who I believe are making one crucial error.

If you use P/E in your trading, as most value investors do, I hope you’ll listen closely.

Because I believe many have got this key metric all wrong.

They believe that great “value” means having the lowest P/E possible.

So they look at all the available stocks. And they’ll find one with some tiny P/E ratio like 3 or 4.

And they’ll think, “Wow, what an incredible value! This stock has no place to go but up!”

But that’s dead wrong.

The lowest P/E stocks often are trading that cheaply for a reason.

It’s important to remember that stocks move up based on there being enough buyers to drive the price higher.

A tiny P/E of 3 or 4 indicates NOBODY wants to buy that stock!

And usually it’s because stocks that trade for that cheap don’t actually have any growth. Who is going to pay a high price for a stock that isn’t growing?

So I take a different approach.

What I like to look at in terms of value is...

I want to see stocks that trade cheaply in comparison with the future growth ahead.

Netflix is a perfect example.

Back in 2010, its average P/E was between 30 and 60.

Now... if I were a P/E hound who bought only stocks that traded at 3 or 4, there is no way I would have bought Netflix.

I would have completely missed it.

But listen, a P/E between 30 and 60 for Netflix... which was growing revenue at an annual average rate of 28%...

And signing up thousands of subscribers every day...

Was dirt cheap!

It actually was an excellent value, as anyone who bought Netflix back then can tell you.

It’s among the top-performing stocks of the 21st century, with a total return of more than 50,000%.

Incredible, right?

So, here’s what I’ve learned...

First, I try to identify top growth stocks. I want to see companies breaking earnings records quarter after quarter.

And THEN I look for a P/E value that’s cheap relative to that level of growth.

I’ve personally found that targeting P/E ratios in the 30-to-60 range can give us tremendous value... as long as the future growth makes the current valuation cheap.

Find a truly great growth stock at that low of a P/E, and you can crush the market.

In fact, The Balance reports that...

“Stocks with a high P/E ratio have produced above-average returns over long periods in the past.”

From here, I run an algorithm to rank every publicly traded company based on growth and value.

Every stock receives a Growth/Value score, ranked on a 1-10 scale – 1 being the worst, 10 being the best.

I will recommend only stocks whose Growth/Value scores are 7 or higher.

And by doing this, we will have eliminated approximately 85% of all stocks from our buy list.

And then comes the important third factor... INCOME.

INCOME

With income, I want to see three things...

First, I want to see strong cash flow of at least double-digit annual growth. This means the company can reinvest in growing the business or distributing the money to shareholders.

That leads me to the second thing: I like to see a strong and rising dividend yield as a bonus.

And last but not least...

This finally leads us to the secret, ultra-elite tool I’ve been telling you about.

I use it to track the third and final income factor...

Which, as you’re about to see, makes it the most powerful tool in my repertoire.

The Special Tool Typically Reserved for the World’s Wealthiest Investors... Revealed

This tool was first created by Deutsche Bank in 1996...

Then in the 2000s, Goldman Sachs began offering it to clients who had $10 million or more in net value...

Some of the absolute richest of the rich.

But right here, right now, I’m going to share it with you.

I hope you’ve got your pen and paper ready...

Those five magical letters are...

C-R-O-C-I.

CROCI.

That’s cash return on capital invested.

It’s a way to take cash flow – which, as I said, is already a strong measure of how a company is doing – and use it to evaluate earnings.

It’s a superior way to judge a company’s financial strength... and the size of the opportunity it presents us investors.

The basic formula is a bit more complicated than what the average investor may be willing to do. But if you have the data at your disposal, I’d say the results are well worth the extra work.

CROCI is calculated by dividing earnings before interest, taxes, depreciation and amortization – also known as EBITDA – by the total capital invested.

This is all information you can find if you’re willing to do some digging...

Or that you can pull instantly if you have a $25,000/year Bloomberg terminal license, as many professional traders do.

But that’s CROCI in its most basic form.

Goldman’s research through its quantum division shows that companies in the top quartile of CROCI ratings beat the market by more than 550%.

Let me repeat that again...

Not 5%.

Not 50%...

FIVE HUNDRED AND FIFTY PERCENT.

You can imagine that the first time I heard that figure, my head spun.

And what’s even crazier is... I probably never would have heard about it, were it not for my deep connections in the financial industry.

As a hedge fund CEO, you’re often invited to exclusive events. I’ve met with billionaires, celebrities and even royalty.

But there was one event that profoundly impacted my investing more than any other...

It was where I first learned about CROCI.

I was at a luncheon with the chairman of Goldman Sachs Asset Management at the time, Jim O’Neill, who is now a member of the House of Lords...

As it happened, I was seated right next to Jim. And truth be told, I was glad that I was. Because I was hoping to sneak him a copy of my just-written book – Mind of a Trader – so he could show it to all his ultra-wealthy friends.

But that wasn’t the reason I was supposed to be there.

The real reason I was brought there was to hear a pitch from Goldman. They were showing off some of their cutting-edge new services.

And it was at the tail end of that event that leaders from the company’s quantum division shared their research on CROCI.

What they said grabbed my attention right away.

It was one of those fly-on-the-wall moments where I thought, “Well, I better listen closely to this.”

They explained that CROCI was a critical tool they used to advise their clients and choose equities.

And Goldman Sachs has some of the richest clients in the world.

Very quickly, I realized... this could be the missing piece of my data-driven strategy. And I was especially eager when I heard that 550% outperformance figure.

So I went home with my notes and got to work, testing it out for myself.

Soon I had put my own unique spin on CROCI...

I found that if I can narrow the list of stocks to the top 15%, I can be more stringent than Goldman Sachs, as they broadly target the top 25%.

In other words, they spray and pray...

While I can be more laser-focused.

Today, as you now know, CROCI is a central piece of my investment strategy.

I’ve been able to tap into one of the most powerful trading secrets... used by one of the biggest behemoths in global finance... stamp my own twist on it...

And NOW, finally put it within reach of Main Street investors.

CROCI is something very few investors know about, but it’s crucial to the success I’ve seen.

In fact, Francesco Curto, who wrote a criminally underread book about CROCI, says...

“Annual returns from this investment approach demand everyone’s attention.”

And the Financial Times says...

“All investors should be aware [of CROCI].”

And yet... 99.9% of investors have never even heard of it.

Which means... you are now part of a privileged few.

An Inside Look at the Most Powerful Tool in My Repertoire

Here’s the big takeaway about everything I’ve just shared...

By the time my system applies these criteria to filter the 10,000-plus stocks on the market... we’ve eliminated more than 99% of them.

The few that remain are the most extraordinary stocks available to us at any given moment.

Period.

They’re often highfliers in bull markets...

And resilient in bear markets.

For example, in 2023... leveraging both stock and options plays to maximize our profit potential... I gave my subscribers not one... not two... not even three... but FIVE opportunities to double their money.

We were ringing the register on doubles and triples every 23 days, on average.

With gains of 123% on Dover Corp in 63 days... 107% on Adobe in 71 days... 109% on Shyft Group in 25 days... 119% on ServiceNow in 58 days... 100% on Molina Healthcare in 71 days...

And right now, my system is targeting three new stocks that I’d like to share the details on...

But before I do, let me show you a specific example of CROCI at work.

We’ll go with a company you’ve most likely heard of... Crocs.

Yes, the rubber clogs with holes on them. They’re not my taste... maybe they’re yours... but none of that matters.

With CROCI, we don’t care about what a stock represents or what industry it’s in.

We could let our personal biases get in the way if we were looking at that company based solely on what we thought about its product.

In my earlier days, that may have happened to me.

But, you see, our personal biases can be dangerous.

That’s why I stick directly to my system and the data.

So when, in October 2020, my system was showing me that Crocs was a top-notch investment opportunity... I didn’t ignore it.

Instead, I dug deeper.

I discovered that while they may not be my favorite shoes, Crocs are loved by millions of people.

In fact, the company was on the brink of hitting a record of nearly $1.4 BILLION in revenue by the end of the year.

And the final quarter would see a ridiculous 55% increase in revenue.

According to my system... this company scored an 8 in Growth/Value... it passed my income metrics... and its CROCI was 13.5%.

I’m always looking for CROCI scores of 10 or higher... ideally as high as possible, well into the double digits.

So a score of 13.5 is actually 35% better than what I look for.

That all added up to a screaming “Buy” signal for me. So I alerted some of my most loyal followers... and sure enough, the stock went on to more than double in a year.

CNBC reported in July 2021 that...

“Crocs sales boomed during the pandemic as consumers [sought] more comfortable footwear.”

That means anyone who ignored Crocs based on their taste in style missed out on an incredible investment opportunity.

But my followers had the chance to capture significant profits, thanks to my system... and, in particular, thanks to CROCI.

One of my loyal U.K. readers, Drew Proehl, told me he invested in Crocs for himself and his grandparents and achieved “WELL over a 100% return” between November and August.

CROX had gone from $59 to $146 at the time he wrote me.

Now let me give you another example... WPP.

You may know it. They’re considered the world’s largest advertising agency.

Now, this was a very public recommendation of mine. I went on Sky News, and the host was trying his best to get me to say the company’s CEO, Sir Martin Sorrell, wasn’t worth a 60% pay increase he’d just gotten.

I argued the opposite. I stood my ground and insisted WPP was a solid investment.

How could I not? The data was on my side.

In fact, that stock had scored a 9 on my Growth/Value formula.

And it passed income and CROCI with flying colors.

It was projected to deliver breakout returns.

Simple as that.

And look what happened to WPP over the following months...

The stock went straight up...

More than doubling over the next 18 months.

Now, if I were a “woke” social justice warrior, mad about CEOs making too much money, I could have protested this pick and refused to invest in it.

But I don’t care how much the CEO makes if he or she is delivering great returns to me, the shareholder.

So I was confident about telling people to consider WPP as a great investment opportunity that day.

Sir Martin Sorrell contacted me after that segment and thanked me for putting things in perspective.

I told him, listen... I don’t have an agenda one way or another on CEO pay. I care only about results for investors.

And my readers, of course.

Like William H., who recently wrote to say:

“Please accept my appreciation for your leadership in these interesting times. Well done, sir! With a smile and a firm handshake.”

Or Carlos G. who said I have an “uncanny ability to discriminate top-notch companies” with the “potential for triple-digit gains.”

“In the few short weeks [since I joined],” Carlos wrote, “I have followed every one of his trades and as a result I am up thousands of dollars. His trading system is a game changer!”

Then there’s Freddy L. He said:

“Thank you for your timely investment recommendations. These are stocks I would not have found even if I tried. Keep up the good work.”

Or lifetime subscriber Rhonda Z. As a lifetime subscriber, she got special access to a recommendation I couldn’t share with everyone. She said:

“I made $6,000 (100% gain) in less than 5 months from your MPTI recommendation. Your service so far is the best performing in my portfolio.”

Or Mike M., another lifetimer who said he is looking forward to many investment successes to come.

“I invested in a lifetime membership and [am] very much looking forward to the many investment successes to come!!!”

I love that. When my readers win, I win.

And it’s in that spirit that I want to tell you about the three new stocks my system is pointing me to RIGHT NOW.

An Award-Winner in AI That’s Already CRUSHING Expectations

The first is a U.S.-based software company that’s making it big in the AI space.

It was a top prizewinner at the AI Breakthrough Awards. And its proprietary software has helped it garner a client list that includes members of the Fortune 500, government agencies and some of the world’s biggest banks.

Of course, we’re not talking about Nvidia or Microsoft or any mainstream stock like those.

While this company may have its admirers within the AI world – and Wall Street – it’s far from a household name.

And that’s just the way we like it.

The company just reported earnings and revenue results that crushed Wall Street expectations. Earnings for the most recent quarter were up 28% from a year ago... and revenues increased by 23%.

That’s precisely the sort of growth we like to see.

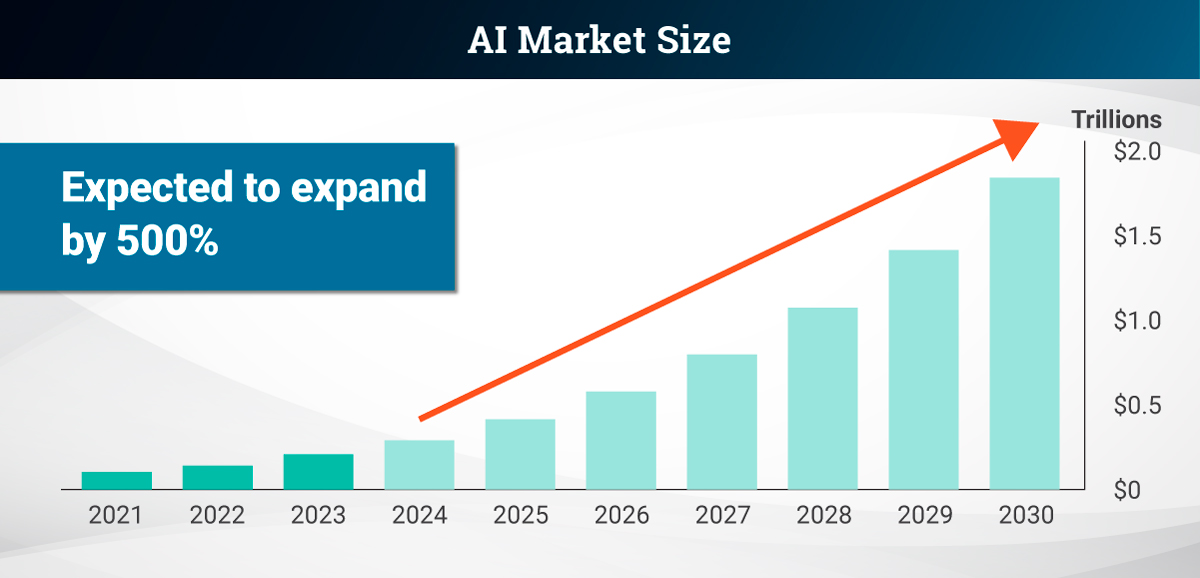

And with the size of the AI market expected to expand by a whopping 500% between now and 2030, I think the company’s current forward P/E of 47.8 is more than reasonable.

I like to think I know something about the topic, too, since I’ve been at the forefront of using AI for myself and my hedge fund.

I made quite the splash last year when I first started talking about what we’re doing. You might have seen me in Business Insider or on Yahoo Finance.

The point is... I’m excited about AI. And I’m excited about this company.

But most important of all, as we’ve said... is what our favorite metric has to say about it. And friends, this stock well exceeds my expectations...

Remember, I’m looking for a CROCI score of at least 10 before I’ll even consider an investment.

And this company nearly DOUBLES that... coming in at 19.4.

That tells me the stock has the potential to go vertical – and soon.

And it’s not alone...

A Grossly Undervalued Play in One of My Favorite Sectors

My next pick has an even higher CROCI score... and its services are in high-demand among its partners in technology, finance and accounting.

Like our first pick, this stock is an award-winning software provider that’s been recognized in Forbes, Fortune, Newsweek and more.

It offers engineering, data analytics and automation solutions to more than 3,000 clients – including, as the company itself notes, “a significant majority of the Fortune 500.”

Anyone who’s been following me knows that I’m big on software companies. And you don’t have to guess why.

Since 2009, global spending on enterprise software has nearly quadrupled. Last year, businesses around the world spent roughly $856 billion on software.

And if you’ve been paying attention, you noticed that several of the big winners that I’ve told you about today are in this crucial and growing sector.

I believe this stock slots right in with them.

The company has a long history that goes all the way back to the 1960s. Over the past decade, its earnings have grown at an average annual rate of 67%.

That’s quite strong.

Despite that, the numbers tell us that the stock is grossly undervalued. Three out of four analysts are down on the stock right now... even though the data is screaming otherwise.

As our system has shown again and again... this is a GREAT sign for what’s to come.

But there’s more...

Last but certainly not least...

We are looking at a CROCI score of – are you ready for this? – 21.2!

Again, that’s MORE THAN DOUBLE what I’m typically looking for here.

It’s the third and most important sign that this company should treat us VERY WELL over the coming months.

Okay, let’s get into our final pick... and the holder of our highest CROCI score in the bunch...

This Essential Business Is Screaming Buy! Buy! Buy!

This stock has me VERY excited.

We’re exiting the tech world... but getting into a sector that modern life simply can’t function without.

It’s a company responsible for the safe transport of essential goods and resources worldwide. Every year, its fleet of more than 100 carriers ship 70 million metric tons of cargo around the globe.

Its services aren’t just in high demand... they’re critical.

Which is why earnings have grown at an impressive annual rate of 51.6%.

The company is also fresh off a merger that will increase the size of its fleet in 2024 while lowering administrative costs to the tune of an estimated $50 million in savings per year.

Wall Street doesn’t appear to be pricing in that added profit... yet. Which gives us a great opportunity to get in ahead of the crowd.

But with that all said...

The biggest reason why my system is screaming BUY! BUY! BUY! right now is, of course, that massive CROCI score...

This one is coming in right now at 26.9... a 169% increase from what I’d normally like to see.

So I’m extremely bullish on this, frankly, it’essential business. It’s making the right financial moves... and I want you to have the chance to get in before the rest of the investing world catches on.

Get My Dossiers on These 3 Explosive Plays TODAY

I have no doubt the opportunities I’ve laid out for you today could be among the top-performing stocks of 2024.

Their CROCI ratings are all off the charts. And my system is screaming “Buy!”

That’s why I’ve rushed to put all the details in these three dossiers I’m prepared to send you today.

You’ll want to review them ASAP. Because the window to hit my profit target on these opportunities could be as small as 100 days.

The only thing that could possibly be more exciting than these plays is where my system will lead me next. And if you want to crush the market this year...

With the help of my elite tool that’s been proven by Goldman to outperform the broad markets by 550% or more...

Then I’m sure you’ll want to be along for the ride.

That’s why, today, I want to give 450 people the chance to get complete details on all three of the stocks I’ve just told you about...

Including the ticker symbols and my specific buy instructions...

Plus every new opportunity my system points me to over the next 12 months.

So to make that possible...

I’m inviting you to check out my elite research service called Alpesh Patel’s GVI Investor.

The launch of GVI Investor marked the first time I ever shared my system in America... offering the type of stock and options plays that made me a legend in the U.K.

And since its debut in late 2022, our portfolio has been on fire. With top performing money-doubling – and even money-tripling – gains of...

- 144% on GD in 83 days

- 250% on WRB in 3 days

- 119% on NOW in 58 days

- 100% on GCT in 145 days

- 109% on SHYF in 25 days

- 123% on DOV in 63 days

- And more.

We’re hitting profit targets left and right. These are some my very best wins from a few years of chaotic markets and financial turbulence. With a near-50% win-rate, we’ve kept our losses small and swung for the fences as often as we could. I have complete faith in this system – and would put what we’re doing up against any of my competitors, any day.

As one subscriber, Jeff K., put it...

“I’m not sure why I should make any other trades outside of GVI. I don't think I have lost any trades with Alpesh!”

Of course, I should mention there is a risk with any kind of investing. And despite Jeff’s enthusiastic endorsement, I’ll freely admit that not every stock or option recommendation in GVI Investor is a winner. You should never invest more than you can afford to lose.

For every position to be a winner would simply be impossible – for mine or any other system.

Yet last year, as investors fretted over inflation and wars and what the Federal Reserve was going to do to rock the stock market next...

In GVI Investor, we managed to close a double- or triple-digit winner every 23 days on average.

Since we launched GVI over two years ago, we’ve closed a double- or triple-digit winner every 36 days on average. So roughly once per month!

Our average return, across all recommendations – stocks and options, winners and losers – was just over 4% in 146 days.

Last year, GVI Investor’s average trade (10.10% in 111 days) outperformed the S&P’s average trade over the same time frame by over 50%.

I’m proud of that level of performance. And more importantly... my subscribers have been thrilled to get regular opportunities each month to score a quick double- or triple-digit gain.

Doing this consistently can have a significant and drastic impact on your portfolio.

I’ve spent a huge chunk of my life as a fund manager and trading coach, helping ordinary people do exactly that.

It’s why, for decades, before I started GVI Investor, I’ve gotten notes like these from my followers:

“Why do you keep doing this to me, making me money! Got my first three-bagger today after [7 1/3] months invested in PDCE – a 214% increase – and took the profits.” – Charles C

“Your mentorship is great... I did manage a greater than 100% return with Zoom. I still have Square at over 100% but am not selling yet.” – Farhaad E

“Personal thank you as always, Alpesh. You have been one of a few people that has made a positive impact in my life, and [I] hope to shake your hand, bump fists or man hug one day... :)” – Nico B

And these days, thanks to the successful launch of GVI Investor, I’m getting so many positive notes each day I barely have time to read them all.

Which is the absolute best kind of problem to have.

But you don’t have to take my word for the success of my GVI system... or the word of my followers.

Because right now I’m putting the three stocks I’ve told you about today in the official GVI Investor portfolio.

Come aboard and you’ll get instant access to my research on these plays... plus every other recommendation currently in my model portfolio.

You’ll get a chance to see firsthand what GVI is all about.

Plus a whole lot more.

Introducing: Alpesh Patel’s GVI Investor

Listen, this project is special to me.

GVI Investor is something I wanted to do for a long time. Because I’m confident that I can give Main Street investors – perhaps you’re one of them – the tools they need to transform their wealth.

But I was missing one thing... an ally to help me on my mission.

That’s why I was so happy to partner with the whip-smart minds at Manward Press. When they approached me about working together, I jumped at the chance to be part of their industry-leading team.

Right away, it became clear that GVI Investor was the perfect addition to their already award-winning lineup.

It gives you – the everyday investing enthusiast – access to the strategy I’ve used to beat the market again and again during my decades-long career.

And as I’ve explained here today, it also gives you access to the most powerful, and certainly most elite, tool in my repertoire... CROCI.

When you join GVI Investor, you’ll gain instant access to its power, plus a number of tools to help you become much more successful...

For example, I have something special today for new members.

It’s called “The GVI Investor Handbook.”

This outlines in more detail my entire Growth-Value-Income strategy.

This handbook contains EVERYTHING you need to know – in simple, precise detail – before putting GVI to work for you.

Look, it doesn’t matter what level of investing experience you may have.

Advanced, intermediate or beginner.

It doesn’t matter if you’ve NEVER bought a single stock before.

This system can hand you superior results.

Of course, whether you choose to use my system for yourself, or you just sit back and wait for my next recommendation... you’re going to have plenty of opportunities to generate potentially life-changing profits.

But with that said...

I understand how overwhelming it can be to comb through piles and piles of new investment ideas.

That’s not what we do here with GVI Investor.

You should know my approach is a little different from most...

A Dignified (and Stress-Free) Approach to Building Wealth

You always hear about diversification.

And of course, it can be a good thing...

Diversification can help spread out your risk.

But ONLY to an extent.

Because, as Warren Buffett said many years ago...

“It’s crazy to put money in your 20th choice rather than your first choice.”

Buffett may have lost sight of that a bit, because he simply owns too many stocks these days!

By my count, Buffett’s Berkshire Hathaway now owns 49 stocks.

That’s too many!

And while no one ever teaches this... the fact is, overdiversification can HURT investors.

If you own too many stocks, then when one turns into a big winner... it ends up being such a small portion of your portfolio that it doesn’t really move the needle.

That’s no good.

Here’s the truth I’ve learned.

It is really hard to outperform the markets if you have TOO MANY STOCKS.

The key to my strategy – and I think you are going to appreciate this – is that we do NOT overdiversify.

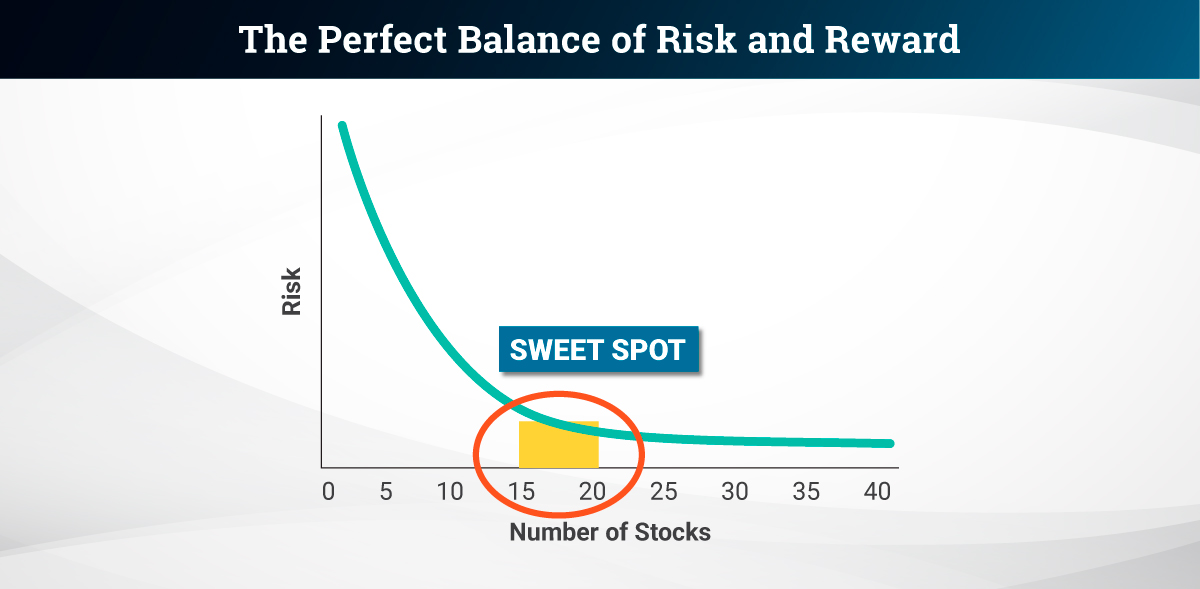

All of my research – and decades of high-level experience – proves 15 to 20 stocks is all you need.

To be clear, I never recommend investing more than you can afford to lose on a single stock.

You can achieve a diversified portfolio and optimal performance with 15 to 20 holdings.

That’s the sweet spot.

It puts you in position for the perfect balance of risk and reward.

Legendary billionaire trader Carl Icahn, for example, holds only 18 stocks.

He’s earned 31% annualized returns since 1968! To put that into perspective... that would turn $1,000 invested into $325 MILLION today.

That’s why, with our GVI Investor model portfolio, we aim to hold as many as 15 to 20 stocks at a time.

It keeps our eye on the prize...

And it keeps us focused on the kinds of companies that I’ve identified again and again over the last three decades...

That can potentially lead to triple-digit returns...

And, with the help of CROCI, have the potential to beat the market by 550% or more.

They’ll come from all industries, all sectors...

They just need to fit my GVI system.

When they do, I’ll split them into two categories: Core-Quality stocks and High-Performance stocks.

Core-Quality stocks will have bigger market caps and be more resistant to volatility.

For example... here are some of the larger companies I hand-picked in the past for my U.K. clients that I’d consider Core-Quality Stocks:

- Marshalls, up 75%

- Disney, up 114%

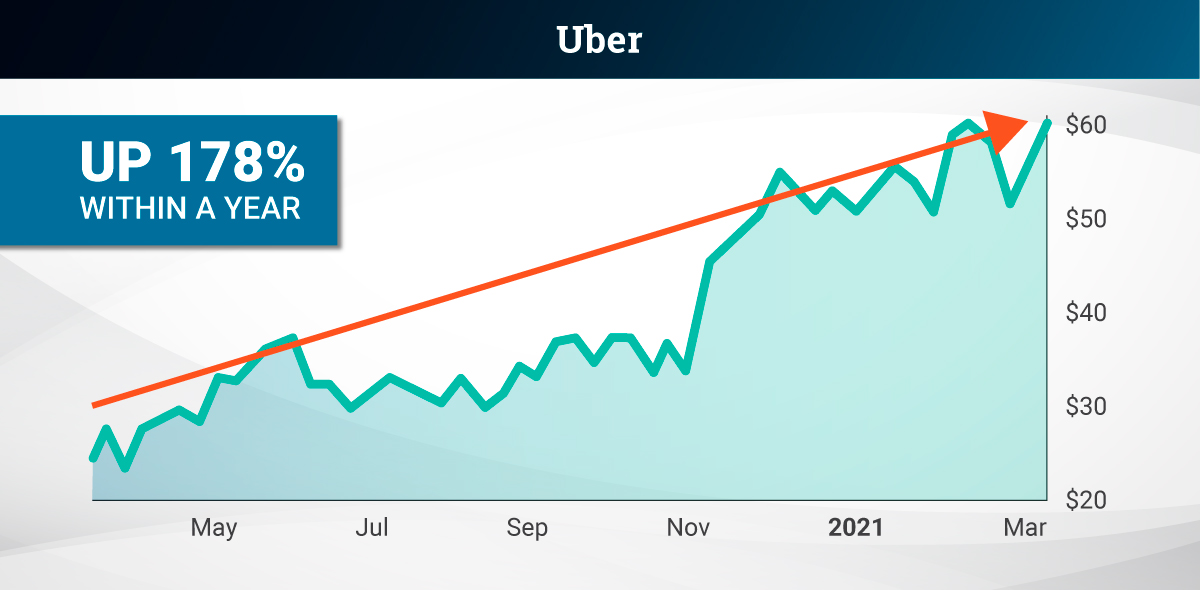

- Uber, up 178% within a year.

To anchor our portfolio, we’ll aim to have five of our positions be Core-Quality stocks.

And I then want the remaining 10 to 15 to be High-Performance Stocks.

These are the types of companies that have the ability to deliver you multi-bagger home runs in a single year.

Now, the names of these stocks might not be as familiar... Many can be up-and-comers.

Take Ramaco Resources, for example. Ticker symbol METC. It’s a bit smaller, so I could only recommend it to my smaller inner circle of lifetime GVI subscribers. That’s the tier of membership that gets small- and even microcap positions. But this is a great example of the type of stock I’d classify as High-Performance.

I first told my VIP GVI Investor subscribers about it in June.

The company isn’t well-known. It’s been around for less than a decade. Plus, as I noted in my write-up for subscribers, it’s operating in an industry – coal mining – that is facing some headwinds that will affect long-term growth.

But as a shorter-term play... Ramaco had a crystal-clear opportunity. At the time, countries around the world – including the U.S. – were ramping up their infrastructure development. They would need coal to get it done. And with a CROCI score of 16, I knew this mining play was a screaming “Buy!”

I sent an alert on June 16.

And, sure enough, by mid-November we were exiting the position for a triple-digit gain.

My readers were thrilled, as you can imagine. Lifetime subscriber Rhonda Z. wrote...

“I just want to drop an email to say thank you for my 120% gain ($12,000) profit on METC. This is my second triple-digit gain from a GVI investment. Thank you so much for your great service and education.”

So, you can see why it’s plays like these that I’ll be focusing on the majority of the time.

But no matter what stock I’m recommending, one thing must always be true... it must fit my strict GVI criteria.

Why Would You Put Your Money Anywhere Else?

To sum it all up, GVI Investor is where I’ll be sharing all of my top investment ideas...

Recommendations...

Predictions...

And warnings.

Everything you need to know to boost your returns in the markets this year and beyond.

All starting with instant access to the three plays my award-winning system is pointing me to right now...

Plus, all members who join me today will get the chance to take part in monthly calls and gain first-rights access to special opportunities in the future.

If you want the opportunity to build transformative wealth in today’s market, you have to stay within my system.

While nothing in the investment world is risk-free, my system is going to eliminate a lot of the noise and speculative plays out there.

Remember, any new stock I recommend must follow my strict GVI criteria.

Growth, value, income – and CROCI.

It’s going to keep you locked into the biggest profit opportunities in the market.

And as I’ve proven today, you don’t have to take big risks to collect triple-digit returns.

We’ve done it again and again and again...

- 144% on GD in 83 days

- 107% on ADBE in 71 days

- 77% on ADSK in 7 days

- 250% on WRB in 3 days

- 109% on SHYF in 25 days

- 100% on MOH in 8 days

- 119% on NOW in 58 days

- 123% on DOV in 63 days

- And many more...

With a system that can identify stocks that you expect to go up 2X, 3X or more in just 12-month windows... why would you ever put your money anywhere else?

And when you become a member of GVI Investor today, I’ll give you all the tools you need to achieve this.

Premier, Hedge-Fund-Level Guidance at a Mere Fraction of “2 and 20”

For the past three decades, I’ve doled out investment advice on CNBC and Bloomberg TV and in the Financial Times.

I’ve managed hundreds of millions of dollars for wealthy clients through my hedge fund, Praefinium Partners.

And it’s earned the distinction of being one of the top-performing hedge funds in the world.

But I’m not going to lie to you... it could cost you a pretty penny to get in.

For the type of outperformance we aim to provide, hedge fund clients typically pay what’s commonly known as “2 and 20.”

2% of your capital upfront.

20% of your profits.

It’s a pittance in the hedge fund world. But no ordinary individual can afford to pay out that much of their profits.

Nor should they have to!

GVI Investor, my first trading research service in America, is not designed for the ultra-rich.

It’s for the people of Main Street... of all ages, backgrounds and levels of investing experience.

So, let’s talk dollars and cents.

In the past, I’ve provided exclusive investment research for some folks in the U.K. and worldwide.

They paid up to 25,000 pounds retail for lifetime access... which is around $31,000.

And I delivered, as my subscriber Brent A. will tell you. Here’s the “over 100% gain list” he sent me...

“My over 100% gain list: Generac, Volex, Medpace, Intuit, Synopsys and 2GOO.”

Those were all over a period of roughly 12 months.

Another subscriber, Freddy R., started following my U.K. research with about 250 euros to invest... and in nine months, he turned it into 14,000 euros.

It gave him the boost he needed to start not one but two shipping companies.

Today, his companies are worth 10 million to 12 million euros.

And he says of his success...

“It’s all thanks to Alpesh Patel.”

It could not be more fulfilling to know that my work helps to change the lives of people like Freddy.

But listen...

I said at the very beginning of this presentation that I understand now is a critical time for investors. And I meant it.

I’m looking to improve the financial lives of as many people as I can. And I don’t want to put up any unnecessary barriers that might keep you from giving GVI Investor a shot.

So I’ve worked out a special deal that I think you’re really going to like.

I truly want to make this available for everyday Americans who need an edge in the markets right now.

The normal retail price for one year of my highly respected GVI Investor research would be MORE THAN fairly priced at a respectable $4,900.

That’s less than a quarter of what I’ve charged in the U.K.

But because you’ve made it this far into this special presentation... and I’ll take that to mean you’re intrigued by what I’ve shown you today... you won’t even pay that!

In fact... because these are unprecedented times... I’m going to make you an unprecedented offer...

For you... and through THIS presentation only... I’m offering a massive 61% off the retail price.

That brings this special one-year subscription to GVI Investor to only $1,899.

You’ll get everything I’ve talked about in this presentation...

Instant access to research on the three stocks my system is pointing me to right now... with CROCI scores that are off the charts...

Plus instant access to “The GVI Investor Handbook” – your complete guide to all the ins and outs of my powerful, award-winning investment system.

And, of course, you’ll get instant access to our full model portfolio, home to every Core-Quality stock and High-Performance stock I’ve recently recommended.

You can peruse every past alert to determine what makes the most sense for your situation right now.

Keep an eye out, too, for my weekly updates on our positions, what’s happening in the markets, new opportunities and more.

And don’t forget our monthly video calls, where I go even more in-depth, giving you a peek at my screen to see exactly what I see as a professional fund manager and trader.

And if all that weren’t enough...

You should know that I’m also willing to guarantee my work...

Your “Win No Matter What” 365-Day Guarantee

I know that once I pull back the curtain on CROCI, you’ll know almost instantly how wealthy this approach could make you.

However, if for whatever reason you’re not completely blown away by my GVI Investor service...

If you’re not able to immediately implement my research to get a remarkable ROI...

And if you’re not absolutely blown away by the quality of my analysis to make you sizable money in short order...

Contact our friendly customer support staff at any point in the next 365 days for a complimentary credit to any other research service inside the Manward Press universe.

But when you consider how quickly you can profit from the three free reports – returns from any one of them could more than cover your one-time subscription fee.

Plus, I’m guaranteeing you’ll get a chance to see six... count them... SIX money-doubling opportunities or more with my model portfolio over the course of your subscription.

If you fail to see six triple-digit winning opportunities... across all my stock and options recommendations... I’ll personally work for you for another year... for FREE.

So what are you waiting for?

This is an extremely powerful and comprehensive investing system.

I’m confident it won’t take any time at all for you to start reaping the benefits of your GVI Investor subscription.

Once you access all my research and see the inner workings of my CROCI indicator... you’ll never be able to unsee it.

And that is why, unfortunately, we won’t be offering any refunds.

At this ultra-low price, we simply can’t afford to let anyone into our system who isn’t totally committed to giving it an honest try.

It wouldn’t be fair to my thousands of other GVI Investor subscribers.

BUT if for whatever reason you’re not satisfied with your subscription at any point in the next year... all you’ll have to do is call my concierge team, and I’ll credit you every cent you paid to put it toward the Manward Press service of your choice that you feel better fits your needs.

Before I’m out of time, I’d like to share one more personal experience of an actual GVI Investor reader...

This one is from a gentleman who is approaching retirement age.

“Thank you for being a good man. A man in a position to help the everyday family. I am that such man, trying hard to provide a better life, future and retirement, as I’m now 62. Yes, if you help a multimillionaire, that’s good. If you can help and make a difference in the lives of everyday people, now that’s something you can be proud of. Thank you from the bottom of my heart.” – Bentley F

Start reaping the rewards by filling out the easy subscription form on the next page. Just click the “I’M READY TO GET STARTED!” button below.

Thank you, again, for taking part in this exclusive presentation.

I’m Alpesh Patel, and I look forward to us working together.

Sincerely,

Alpesh Patel, OBE

DEALMAKER, U.K.’s Department for International Trade

Founder, Praefinium Partners

Founder, GVI Investor

February 2024