Hello, I’m Shah Gilani.

Welcome to this important briefing.

You’ve made a great decision to join me today.

Barron’s just declared:

And this time, it's not just hype...

Because history is in the making...

President Donald J. Trump – the self-styled Crypto President – is on a mission to, in his own words...

“Make America the crypto capital of the world...”

Circle's buzzy stablecoin IPO exploded 168% to $20 billion on day one...

Bitcoin just hit a record high above $112,000...

The President personally has 40% of his net worth tied up in crypto.

And now he could be just DAYS away from signing a new crypto law...

His top crypto advisor... billionaire David Sacks, says this law could...

“Create trillions of dollars, practically overnight...”

CNBC reports the moment Trump signs this bill into law, Wall Street CEOs are ready to jump into crypto.

Forbes says America's biggest banks, including Citi and Morgan Stanley, have developed plans to “leap in” the moment President Trump gives the green light...

Bank of America's CEO told Fortune:

“It’s clear what’s going to happen, and we’re ready to flip the switch ‘the moment’ it does...”

Here's why this is urgent for you.

For the first time, The President, the Government, Big Tech, and Wall Street are all-in on crypto...

Vice President J.D. Vance calls it...

“A once-in-a-generation opportunity...”

With $3 trillion at stake for Americans.

But while the big banks and Wall Street have to wait for the President to sign the bill before they take action...

You can make your move now.

Bloomberg said negotiations for the bill are still ongoing. But the President has said he wants to sign this new cryptocurrency bill into law before the Congressional recess in August...

Bloomberg reports “there is an increased likelihood it could pass within days.”

This is a huge advantage for you.

Because THEY can’t make a move ‘til it’s done.

YOU CAN MOVE RIGHT NOW.

That’s why I’m here holding this emergency briefing.

To make sure you know exactly what’s happening... and how to position yourself ahead of the biggest players on Wall Street.

If you’re skeptical, I don’t blame you.

There’s been a lotta crypto hype over the years.

Most of it was complete garbage.

But the fact is some people HAVE turned tiny stakes into life-changing fortunes with crypto.

Last year, according to Barron’s, the number of crypto millionaires in the United States doubled to 172,000...

And with a stroke of his pen...

President Trump could be about to double, triple or even quadruple the number of U.S. crypto millionaires before the end of his second term...

If you think that sounds impossible...

I get it.

For years, we’ve heard what MIGHT happen if and when crypto goes “mainstream”...

Don’t take my word for anything. Just review the facts, so you can see the proof for yourself before you make up your mind.

I’ve invited a special guest to join us tonight.

Because here’s the thing...

I didn't figure this out on my own.

This is someone who, 2 years ago, I didn’t know very well.

A young guy – a self-made millionaire in his 30s – who’s been investigating the crypto space since 2014. And made a buncha money buying crypto early.

He’s worked with some well-known economists and financial institutions, including Merrill Lynch.

And he had made some good public calls in his different research services over the years, like...

October 2021... When he recommended Nvidia as a way to profit from the processors used to mine cryptocurrencies.

The stock is up 7X since then.

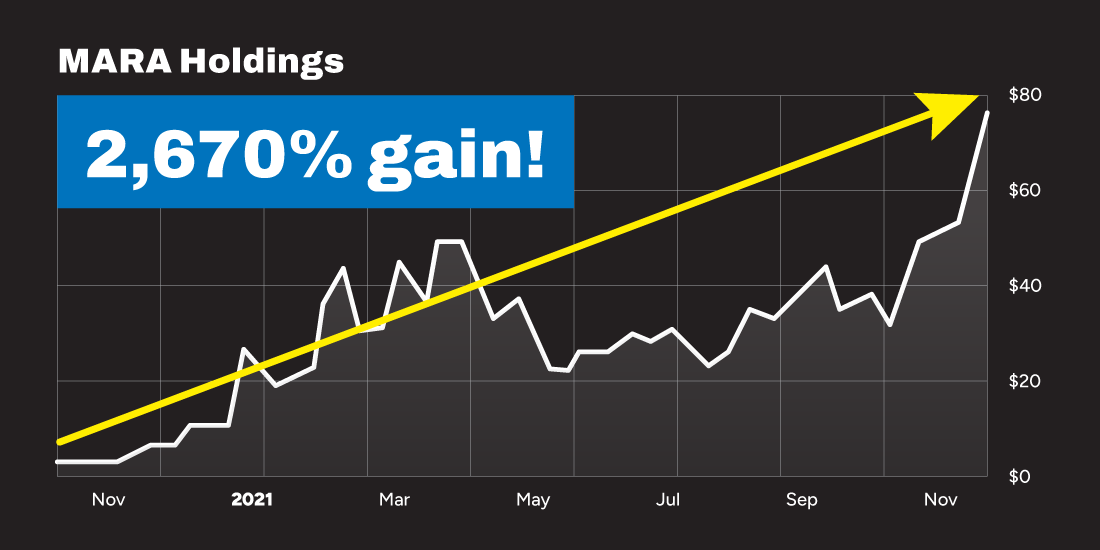

He recommended Bitcoin miner, MARA holdings. It went from $2.74 to $75... A 2,670% gain in a month... Enough to turn $5,000 into $133,000.

His personal crypto portfolio doubled last year.

And is up 365% in the last two years.

And he has recommended Bitcoin a number of times on his Substack...

Including in April 2023 – when it was trading at a then record high of $30,000 a coin...

Giving his Substack readers at the time the chance to buy before Bitcoin’s most recent 294% rise since then...

So I started keeping tabs.

And 12 months ago we sat down...

And he proceeded to tell me...

Bitcoin would hit $150,000.

It has almost doubled since we spoke a year ago.

He told me alt-coins could see potential gains of 500%... 1,000%... 2,000%... or more over the coming year.

Now, I’ve been doing this for 40-plus years...

I’ve heard plenty of guys make big claims that didn’t work out before...

So after our meeting, as a kind of test, I started keeping tabs on those smaller alt coins...

And while the recent run-up in Bitcoin has been impressive...

I personally witnessed GOAT... an AI alt-coin... explode 48,000% in a month.

That turns $500 into $240,000... almost a quarter of a million dollars.

MOODENG... another AI alt-coin... spiked 192,596% in two months.

Virtuals Protocol jumped from 3 cents in September to $4.60 by New Year’s Day. A 16,112% gain... in four months.

Turbo surged 1,700% in three weeks... and ultimately ended the year up 2,460%.

Popcat... an alt-coin on the Solana network... went from eleven-and-a-half cents to almost two dollars, and ran up 1,600% between the Bitcoin halving in April last year and November...

President Trump’s own coin... TRUMP... skyrocketed 6,078% in 48 hours.

Now anyone can cherry-pick a few big winners in a crypto cycle, right? And I was watching, but I wasn’t personally lucky enough to see big peak gains like this.

But to my surprise...

Dozens more alt-coins returned between 200% and 9,000% over the past year...

Even a smaller investor, starting with just $100, could have seen life-changing peak returns of $10,000... $50,000... $100,000 or more... in just a few months to a year.

So he had my attention...

And I looked back through his earlier research services...

In 2023, he identified early signals of Bitcoin ETF approval, and predicted $78 billion would flow into Bitcoin, pushing it to $130,000.

The ETF was approved three months later, and Bitcoin hit $105,000 for the first time.

In July 2024 – he predicted Trump would treat Bitcoin as a “strategic reserve asset” and that his election would “reinvigorate a crypto bull market.”

This was even before Trump won.

So when it unfolded exactly as he said it would six months later... I started to think maybe there was something to this guy...

He also predicted governments would own Bitcoin by the end of the bull market – and here we are, and the U.S. has 200,000 Bitcoin in its Treasury.

In May of 2024, he wrote an article on investing in a future trillion-dollar industry...

Where he called stablecoins...

“One of the fastest-growing crypto markets.”

The total market value of stablecoins surged from $20 billion in 2020 to $246 billion in May 2025, according to analysts at Deutsche Bank.

Asset manager Bitwise predicts the stablecoin market will reach $400 billion by the end of the year...

So he has called almost every major move in the market for the past two years – months in advance of any other analysts I know of.

So this is someone I think you need to pay attention to...

And I’ve called in a favor to connect you with this expert who can give you the cold hard facts about a very real, urgent, event expected to take place just days from now in the White House...

This is not about speculation.

It's about legislation.

And an historic moment that could prove very profitable for you.

I know your time is valuable.

So to thank you for joining us... and to prove to you how BIG this opportunity is... my guest will share the name of one crypto coin he believes every American needs to buy ahead of this new law.

You want to pay attention to this...

Because once this guy discussed a computing company at an event...

It soared to a peak of 1,000% in less than a year.

If he’s right...

This coin could double, triple, or even quadruple before the end of the year.

And I’m personally excited to hear what he has to share with us tonight.

Let’s welcome the most plugged in crypto trader I know, Robert Ross.

Robert welcome, and thank you so much for making the time.

Thank you for inviting me, Shah. Always a pleasure to be here.

So let’s not keep anyone in suspense, Robert...

What exactly is happening?

So... In short?

President Trump is taking historic action to deliver on his promise to make the U.S. the Crypto Capital of the world.

And he’s flipped Washington on its head in the process – from a crypto-hostile environment to a crypto-friendly environment.

Go down the list...

He’s launched America’s Strategic Crypto Reserve...

He's held the first-ever Digital Assets Summit at the White House.

He banned the Fed from launching a central bank digital currency...

Repealed Biden’s anti-crypto policies.

And declared an end to “the federal government’s war on crypto.”

How did he do that?

He reorganized the DOJ, the SEC, and Treasury to halt or reverse most enforcement actions...

He got the SEC to dismiss over a dozen cases against crypto companies, including Coinbase...

And the Justice Department to disband its national cryptocurrency enforcement team.

He also directed Treasury to build a full national crypto framework And made the U.S. the world’s largest state holder of Bitcoin...

So, in short, the “Crypto President” is paving a new path for crypto...

That’s exactly right.

And for people who don’t know...

You’ve actually called this every step of the way, over the past 2 years...

It’s been quite remarkable to me and anyone else following you.

But let me ask you...

We’ve all seen a lot of crypto hype before.

What makes this opportunity different?

OK I get it. I know some people don’t care for crypto...

And I don’t blame them. There’s been a lot of nonsense in the past.

But this is different.

Because for the first time, Government, Big Tech, and Wall Street are all on the same page.

And it’s not just the president.

Right. Go on, please... especially I wanna hear about the president.

He has stacked his cabinet with crypto advocates, who have disclosed Bitcoin and crypto holdings totaling millions.

From David Sacks, his “Crypto Czar...”

To Treasury Secretary Scott Bessent, who holds half a million in Bitcoin ETFs, and is openly pushing for stablecoin legislation to protect dollar dominance.

President Trump nominated Paul Atkins... a long-time crypto advocate... to run the SEC.

He’s working with more than 300 crypto-friendly senators like Cynthia Lummis... to fast-track crypto bills through Congress.

He's got Vice President JD Vance – a strong crypto supporter.

His Director of National Intelligence, Tulsi Gabbard, owns BTC, ETH, Solana, and more.

Sean Duffy... now Transportation Secretary... reported over $1 million in crypto holdings.

Robert F. Kennedy Jr. reported a Bitcoin Fidelity crypto account valued between $1 million and $5 million...

How about Howard Lutnick?

Former head of Cantor Fitzgerald... Trump’s new Commerce Secretary... one of the richest and most connected men in America...

Lutnick says he holds hundreds of millions in crypto.

Cantor recently invested $1 billion into Strategy, Michael Saylor’s company, and holds millions in Bitcoin and Ethereum ETFs.

And has publicly supported the idea of a government-held Bitcoin reserve. So institutions are embracing crypto at the highest levels.

How about his son... Brandon Lutnick?

He just launched a $3 billion crypto acquisition fund with Tether, SoftBank, and Bitfinex. Tether alone pledged $1.5 billion in BTC.

So that’s a lot of people with an incentive to see crypto go mainstream.

And then of course, there’s the Trump family...

Exactly Shah. They are The First Family of Crypto...

Break some of that down for anyone who doesn’t know... I know a little bit, but really what’s going on there?

CBS News reports the President’s net worth has increased around $2.9 billion thanks to crypto investments.

The Trump Media group is preparing to invest $2.5 billion into building its own private strategic crypto reserve.

Eric Trump and Don Jr., Trump’s sons, have both made significant investments in the crypto community.

Earlier this year, Eric Trump and Donald Trump Jr. announced a major deal with Bitcoin mining firm Hut 8.

Their company, American Data Centers, merged into a new venture called American Bitcoin... and took a 20% stake in the company...

And they’re preparing to take that company public...

So they’ve stacked the deck in Washington...

And now the Trump family is taking over in the private sector, knowing the cards are going to get dealt in their favor, right?

Eric Trump is the Chief Strategy Officer...

In a joint statement with Don Jr., he said:

“From the start, we've backed our conviction in Bitcoin – personally and through our businesses. But simply buying Bitcoin is only half the story. [Mining Bitcoin] opens an even bigger opportunity.”

So they’re into mining crypto too?

Yes. Trump has said he wants all remaining Bitcoin mined in the U.S.

And in addition to that...

The Trump family owns 60% of World Liberty Financial, a major DeFi (or decentralized finance) platform. Which has already raised $550 million.

They launched their own stablecoin (USD1) and meme coins $TRUMP and $MELANIA.

And a UAE-backed fund just pledged $2 billion into the Trump-affiliated stablecoin.

In fact, Trump’s crypto wealth now represents 40% of his net entire worth.

So it’s personal...

America’s first family is ALL IN... They have billions invested...

Congressmen and Senators and White House insiders have millions invested...

It makes me think...

They’re going to do everything in their power to push crypto higher.

You’re exactly right. It’s in their self-intereset.

As one top transition official said:

“Trump is going to be very focused on the price of Bitcoin... It’s another stock market for him. And we all know how much he cares about the stock market... He’d love to see Bitcoin hit $150,000 early in his presidency.”

We’re already edging closer...

And others think it will soon go even higher...

Standard Chartered, H.C. Wainright, and the consensus of a number of experts actually see it going higher – to $200,000 by the end of 2025.

Chamath Palihapitiya, a venture capitalist, projects $500,000 in 2025, framing Bitcoin as a “sovereign insurance policy” that nations will increasingly incorporate into their financial strategies.

Some of Wall Street’s biggest names predict it could go over $1 million per coin by 2030.

It doesn’t take a genius to see the writing on the wall here...

Washington is now FULLY embracing cryptocurrency. In a BIG WAY.

And likely within the next 35 days, the President is gearing up to sign this new cryptocurrency bill that could change the game for crypto investors.

How so?

Right now, there are two bills.

There’s the GENIUS Act in the Senate...

And the STABLE Act in the House.

And these bills are important, because they make it legal for big banks, financial institutions and tech companies to start using Stablecoins instead of U.S. dollars.

I can hear the questions out there already: like, what the heck is a stablecoin? And why should we care?

OK. That’s a great question. Think of it this way...

You’ve heard people say Bitcoin is like digital gold, right?

Right.

Well, in the same way Bitcoin is like gold, a stablecoin is like a digital dollar.

Explain please...

You know how the price of a cryptocurrency can fluctuate wildly?

I think we all know that.

Just to give an example from the current markets... In the past 60 days, we’ve seen coins like Keeta up 656%...

Edge and MIU up over 800%...

Fuzzy up 1400%...

And Launch Coin, you won’t believe this, up 27,000%...

Which is absolutely fantastic.

It is fantastic.

But stablecoins... Like a regular dollar bill... are designed to always have a purchasing power equal to exactly $1.

So they don’t swing in price like a typical crypto?

No. That’s because they’re built for one thing: daily use.

Um, what kinda use?

Stablecoins allow you to send money anywhere on Earth, instantly, 24/7, and for pennies on the dollar.

Can’t we do that with a credit card now?

For a fee, you can, yeah.

So long as the bank doesn’t block it.

With stablecoins... there are no banks, no delays. No middlemen. No weekend or holiday closures. No currency exchange drama. No 3% credit card fees.

So basically, it’s like Venmo... which I use. But it’s global?

Think about it like this. The Bank of America CEO Brian Moynihan put it like this...

He said: If you go down the street and buy lunch, you can pay with Visa, Mastercard, a debit card, Apple Pay, right?

Right.

Well, he said stablecoins would just be another form of payment.

No different than a money market fund with check access...

“No different than a bank account.”

And the banking system will come in hard on this.

He said...

“We have hundreds of patents on blockchain already, we know how to enter that field. If they make that leap, then we will go into that business.”

Let me ask you probably a dumb question...

Why would anyone want a stablecoin if it only stays at a value of $1? Don’t people only invest in crypto because it can go up insane amounts?

The investment story goes far beyond the stablecoin...

It’s about a whole new financial system that’s about to go mainstream.

But is it really THAT big of a deal?

Some people choose to buy things with crypto, I get it, instead of a Visa card... Is that such a big deal?

If you look at the history, investing in new forms of payment...

Investors could have made as much as 6 times their money on PayPal in 5 years...

22 times their money on Visa in 17 years...

Or 130 times their money on Mastercard in 19 years...

And while it’s impossible to separate Apple Pay from everything else Apple, you know, the core business, like iPhones and Airpods... it’s estimated to do $10 trillion in transactions annually.

Wow, $10 trillion in transactions... So there’s serious money to be made IF people adopt it... right?

They won’t have a choice.

What do you mean by that?

Tech giants like Apple, Google, Meta, and Microsoft have already built or tested the backend infrastructure ;to support stablecoin payments – inside their wallets, platforms, and apps.

So they’ve already built it, before the law is signed?

They’ve been working on this for years...

In 2022, Google partnered with Coinbase to integrate crypto into Google Pay.

Meta built an entire digital wallet system... called Novi... before pausing it for regulatory clarity.

Stablecoin payments are now available on Apple Pay.

So they’re all just... waiting?

Exactly.

They’ve already poured billions into this infrastructure.

They built it because they knew this moment would come.

And once this legislation passes...

They flip a switch... and suddenly 3 billion people have the ability to start transacting with stablecoins.

Apple Pay can already process stablecoin payments.

Meta’s Messenger or WhatsApp can instantly send stablecoins peer-to-peer.

Google Pay can connect directly to crypto wallets.

Microsoft can embed payment solutions into enterprise software or cloud services.

And that’s just scratching the surface... Of course rollout and full adoption will likely take some time. But from the research I’ve been doing, to me it sounds like the whole system has already been built, it’s just awaiting regulatory approval.

These guys have been planning our future. What are the chances these bills don’t pass?

The GENIUS Act passed two major Senate hurdles... 66 to 32, then 69 to 31.

The STABLE Act passed committee 32 to 17 in the House.

That’s rare bipartisan support.

And think about this...

Apple has 1.3 billion active iPhones.

Meta has 3 billion users between WhatsApp and Facebook.

Google runs Android.

The moment this legislation passes, 3 billion-plus people can start using stablecoins...

And they won’t even know they’re using crypto.

Wait, what? They won’t know? They don’t know?

It’s all built into the backend.

The app will convert your dollars to stablecoins to complete the transaction.

When you use PayPal USD or Apple Pay or whatever with a stablecoin backend...

You’ll tap a button to send $50 to your friend...

And under the hood, the app will convert your real dollars to a stablecoin like USDC to settle the transaction instantly.

You won’t see the blockchain.

You won’t even know it’s there.

It will just feel like sending money with Venmo or Zelle... except now, it’s faster, cheaper, works worldwide, and runs 24/7.

I’ve only imagined this happening. So you won’t need a crypto wallet?

No passwords?

You’re not going to need any of that.

The crypto disappears.

What you’re left with is just a better version of money.

So we’re not investing in the coins, we’re investing in the infrastructure.

Exactly.

Explain that, please...

Look, in the late ’90s, everyone thought the big money was in owning dot-com domains.

But the real fortunes?

They came from the “picks and shovels.”

Cisco built the routers and switches that powered the internet’s plumbing. Its stock jumped 99,000% in the 10 years from its IPO to its peak.

Oracle built the databases behind every major website. It grew more than 60,000% in that 14-year run alone.

PayPal became the default payment rail for e-commerce. It launched with eBay, then scaled globally.

None of those companies were the internet, right?

Right. I get that. They just made it possible to do the things the internet lets us do.

Same thing today with stablecoins.

You don’t make money by holding digital dollars.

You make money by owning the tech that moves it, stores it, verifies it, and connects it to the real world.

The blockchains that support stablecoin traffic...

The financial rails and payment apps that facilitate stablecoin transactions...

The asset tokenization platforms that run on top of those stablecoins...

And the DeFi protocols that settle, swap, and secure those digital dollars...

Absolutley brilliant. But I think you may lose a lot of people with de-fi this, and tokenization that.

Bottom line... when 3 billion people start using stablecoins... those networks are gonna light up?

That’s the idea.

With an opportunity THIS BIG, this gigantic, I have to assume people are already moving on this... I mean, we know everybody on the backend is... Everyone on Wall Street obviously is... Everybody in Silicon Valley is...

Spending on stablecoins hit $246 billion as of May.

And is predicted by some to hit $400 billion by the end of the year...

So even before the bill is signed, there’s real money flowing into the space... I see that.

So think about it like this...

According to Forbes, on their own, stablecoins would already be a top 20 U.S. bank.

Tether, the world’s largest stablecoin issuer, reported a net profit of $13 billion last year...

And just days ago, Circle – Tether’s main competitor – launched on the New York Stock Exchange... It soared 170% in a day, and hit a valuation of $18 billion.

Yeah I saw that. Fantastic. OK, so this is not some tiny cryptocurrency gamble we’re talking about investing in here...

But an industry – an entire Universe – worth billions of dollars...

Yes, Daily stablecoin transfers now regularly exceed Visa’s entire network.

And the biggest and most conservative players in finance... are already positioning for this.

- You’ve got BlackRock... holds over 228,000 Bitcoin on behalf of clients. That’s a $15 billion bet... that grows every day.

- Goldman Sachs is offering 2% yields on Solana through new crypto lending desks.

- CalPERS, the largest U.S. pension fund, has allocated $15 billion to crypto-related assets... including Bitcoin, Ethereum, and even AI-tied tokens.

- And Bank of America’s CEO publicly said Bank of America is prepared to launch its own stablecoin...

CalPERS? Now that’s not a hedge fund.

That’s retirement capital. The most conservative money I think in the world.

These are the institutions that manage retirements, endowments, national wealth... all betting on crypto’s mainstream adoption, right?

Exactly right. These aren’t gamblers chasing meme coins. This is legacy money... Investing in the future of finance...

But here’s what matters most:

They legally can’t finish positioning until the final regulatory framework hits in July.

The SEC, Treasury, and Congress are all working towards that deadline.

That means every institutional buyer... from hedge funds to family offices to sovereign wealth funds... is in positioning mode right now.

They’re accumulating slowly. Carefully. And some of them quietly.

But once the regulations are finalized?

They will unleash a flood of capital like we’ve never seen.

So... I’ve got a tough question for you... I hope you have a good answer... are our viewers... is the public... are we too late?

As you know, Shah, institutions move slow.

Painfully slow.

They’ve got:

- 45-day SEC notification requirements.

- Board approvals.

- Risk committee sign-offs.

- Position size limits.

They’re like an aircraft carrier trying to parallel park in a crowded marina.

But people like me and you, and our viewers at home?

We can move instantly... before their filings hit the wire... and before prices move...

And we’ve seen this play out before...

This is the playbook:

- First the legislation.

- Then the infrastructure.

- Then the capital.

- Then the headlines.

By the time the media reports on it?

The move is already over.

So if you’re a regular investor watching this...

You’re not just “early.”

You’re in the only position where you can still get in before the institutions finish building their stakes.

The filing delays are a huge advantage, right?

I mean, BlackRock. Fidelity. Goldman... they can’t just buy something and go live on CNBC talking about it.

They’ve got to:

- Get internal board and committee signoff.

- They have to slice their buys into tiny bite-sized orders so they don’t move the market.

Meanwhile?

Regular investors like us, like all of us, can move in 60 seconds.

Exactly.

But... this is kind of a straight-up question? Isn’t some of this already priced in, Robert?

Isn’t the ship halfway out of the harbor?

Because we’re talking about stuff you already know has happened... and some of our viewers know have happened...

Shah, I’ve been doing this a long time...

I’ve been buying Bitcoin since it was in the four-digit handle...

And I would say...

Not even close.

Because here’s what we’ve seen every time a regulatory breakthrough hits:

When the Bitcoin ETF was approved in January 2024, Bitcoin jumped 7% that day...

And then more than doubled over the next 12 months.

When the SEC dropped its Coinbase lawsuit in February, Ethereum popped 13% in 48 hours.

Why?

Because in crypto, regulatory clarity = capital acceleration.

Every time the government flips the switch, money floods in... and the people who bought even a week before?

They walk away with the lion’s share of the gains.

Robert, we can see all these institutions positioning... but how do we know this will actually drive prices up?

Shah, that's exactly what I'm saying. This isn't speculation. It’s simply mathematics.

When institutional money flows into crypto, the same pattern happens every single time.

Let's start with the most recent example. My Bitcoin ETF prediction in October 2023.

Yes... What happened?

I predicted institutional money would flood in.

And two months later, Blackrock and others launched Bitcoin ETFs. The Wall Street Journal reported Blackrock’s Bitcoin ETF was the fastest ever to hit $10 billion in assets.

Bitcoin went from $27,000 to $105,000. A 294% gain in just a little over a year and a half.

Kudos to you. That was a brilliant call, my friend. But that’s just one example. Give us something else.

So let’s dig into a few more then.

In addition to that, in 2024 MOG Coin was up 5,132%...

In the same time, MANTRA popped 5,779%...

AERO jumped 2,663%...

TURBO was up 2,451%...

And there were multiple 1,000%+ winners – like BitGet... DogWifHat... PEPE... along with many more...

Right, but that’s only one instance, right? I mean one occasion that moved them all...

Let me show you the pattern.

2020: MicroStrategy, Michael Saylor’s company, announces a $425 million Bitcoin purchase.

First major corporate adoption that we’d seen.

But what happened next?

Bitcoin went from $13,000 to $61,000 in six months.

Ah yes, but if I’m not mistaken, it wasn't just MicroStrategy buying.

Tesla followed. Square followed. The institutional dominos started falling...

That’s right.

One institution leads to more.

Every single time.

Because once one major institution validates the asset, others follow.

And it didn’t just affect the price of Bitcoin...

Polkadot soared 1,380%...

Cardano went up over 2,100%...

And many others... all within that same six-month period.

It really is crazy the amount of money you can make in crypto... just from the hype generated by a few corporations going in on one project, i.e. Bitcoin.

The same pattern plays out again and again in crypto.

Just like Ethereum and smart contracts in 2016-2017.

When institutional developers started building real applications on Ethereum...

OK, so tell us what happened?

Ethereum exploded from under $10 to over $1,400 in a little over a year.

A 16,000%+ gain.

And as Ethereum popularized Blockchain utility, you saw coins like NEM rip 29,842% in a single year...

I remember because I personally bought ETH at $416 in 2017...

Saw DASH soared 13,900%...

And Litecoin went up 5,046%...

And Ripple skyrocketed, you’re not gonna believe this, 36,018% – enough to turn every $1,000 invested into $360,000. All in a single year.

Oh I know, I missed that one. I’ve tracked institutional flows my entire career – but not on cryptos. And the pattern is almost always the same.

Although the gains in cryptocurrency are extraordinary! You don’t normally see 360 times your money in the stock market.

But how do you know institutions are still buying?

One of the best things about blockchain is you can track whale transactions. Wallets holding over $1 million.

These surged in mid-May, days before Bitcoin broke $109,000.

So you have an inside window young man. The smart money moved first again?

Hedge fund manager Paul Tudor Jones started buying Bitcoin in 2020...

He calls this the early-mover signal for Bitcoin...

He believes every major rally has seen big institutions load up on Bitcoin.

But the key difference is Institutions don't just buy once and stop. They accumulate over time.

Right. That’s the way institutions operate. When you’re managing billions of dollars, you can't just jump all in at once.

So they buy in waves, Correct? Each wave drives the price higher. I get that.

And typically retail follows each wave, right?

Like clockwork.

Coinbase's data proved this during the recent rally.

Institutions were buying while retail was selling ETFs.

When you have institutional buying and retail selling... doesn’t that equal a massive supply shortage?

Is that what’s driving these explosive price moves...

I believe it all comes down to that math... it’s really quite simple.

But what if institutions change their minds? What if they sell?

That's the beauty of tracking the data. You can see when these moves are coming.

How?

When institutions start selling, whale wallets move coins to exchanges.

The NUPL spikes above 75%.

For those playing at home, Robert, tell them, what’s a NUPL?

It stands for net unrealized profit and loss. And I’ll break it down very simply. It’s the difference between the unrealized profit and the unrealized loss for all Bitcoins in existence.

This indicator has a great track record.

A NUPL reading of 75% or higher is known as the “euphoria zone” – and it has coincided with the last five tops in the Bitcoin price.

So you can get out before the crash?

You get multiple warning signals before any major top.

I've called major tops using these indicators.

In 2021, I warned about the crash from $64,000 when NUPL hit 75%.

And you were right?

Yep, Bitcoin crashed to $30,000. But here's the key...

Even during that crash, the smart money was accumulating.

When FTX collapsed in 2022 and Bitcoin hit $16,000... who do you think was buying?

Well, I’m sure the institutions were...

The super whales. People holding 10,000+ Bitcoin.

They were betting on the next institutional wave. And they were right.

So even the crashes are part of whole this pattern?

Yes. The crashes are when smart money accumulates for the next cycle.

It's all part of the same repeatable pattern.

A mathematical pattern that's repeated for over a decade.

Oh I love patterns. And you think it's happening again now?

I don't just think it. I know it’s happening.

The same institutional infrastructure that drove Bitcoin's 294% gain in just a year and a half is being built for the entire crypto ecosystem.

What do you mean by that Robert?

BlackRock, Fidelity, Goldman Sachs, JPMorgan... they're not stopping at Bitcoin.

They're positioning for stablecoins and the next wave of institutional adoption.

And then what happens?

The pattern repeats. Institutional money flows. Supply gets locked up. Prices explode.

How can you be so certain, Robert? I mean you sound certain... you’ve been so right. But how can you be so certain??

Because it's happened the same way every single time for over a decade.

From what I’ve seen the pattern doesn't break. It just repeats at larger and larger scales.

So the opportunities to target huge gains are seemingly inevitable, right?

When you follow the institutional money flow pattern, yes.

And here’s the key:

Institutional money doesn’t chase headlines. It moves on certainty.

Once they see legal clarity... they don’t hesitate.

They go all in.

So when the bill passes...?

Until now, the regulatory gray area kept this capital sidelined. But as soon as these bills are signed... crypto becomes regulatory compliant.

It’s legally greenlit.

And when Wall Street flips the switch... That’s when prices respond.

Ooh, gosh. I wanna get started buying right now. So what you’re saying is, and what I 100% agree with, is by the time Wall Street gets the green light, when all this does happen, it’s too late to get in at really favorable pricing, right? That’s what you’re saying?

Way too late.

If you want to be in before the money, before the institutions, this is the window. And it’s shrinking fast.

Robert... I want to pause for a second and speak directly to our viewers.

Look... I’ve been doing this a long time... over 40 years now.

I started my professional trading career on the options trading floor in CBOE in 1982.

And if there’s one thing I’ve learned, and by the way there’s been a lot I’ve learned, it’s this:

Markets move A LOT on certainty.

Every major financial boom I’ve ever witnessed began the same way...

Government doesn’t stop the money. It starts it.

It started right after Washington stepped in and rewrote the rules.

Think back...

- In the ’90s, telecom deregulation unleashed a gold rush. Cisco, WorldCom, the entire broadband buildout – it all came after the government cleared the runway.

- When they finally legalized online banking, that’s when we got PayPal. That’s when fintech exploded.

- And more recently? Look at cannabis.

For years it was illegal. Fringe. Taboo.

But the moment regulation shifted... even slightly... capital flooded in.

Stocks soared. Billion-dollar brands were born. And early investors who saw it coming made a fortune.

This is the pattern.

- Step one: Legal certainty.

- Step two: Institutional adoption.

- Step three: Explosive growth.

And that’s what we’re seeing again right now.

The president and his family are all in.

A good chunk of the government is all in.

The banks are all in.

Wall Street is in.

Big tech is in.

This is a really exciting moment.

That’s exactly right, Shah.

We’re at that exact moment now...

The bills are moving. The infrastructure’s built. The institutions are ready.

This is the setup.

You know what, Robert?

This is so much bigger than I even imagined.

I came into this thinking we’d be talking about a new corner of the crypto market. Finding tiny coins to buy. Which is something I know you do very well...

But what you’ve shown us... it’s not just a trend.

It’s not a niche.

It’s a complete shift in how the entire global financial system is going to operate.

And honestly? I don’t think the average investor has any idea how big this could be.

And I couldn’t agree more.

Because we’re not chasing some crypto hype right now.

We’re positioning ourselves in front of a complete rewiring of how the world handles value.

According to Bain Capital, there are $540 trillion – with a T – worth of private assets... real estate, equity, debt, private funds... that exist outside the financial system.

$540 trillion?

So this is so much bigger than just payments.

Today, only about $77 billion of those private assets have been digitized.

That’s just 0.01% of the total.

But if even 1% of that $540 trillion gets digitized?

That’s a $5.4 trillion shift in how money and assets move.

That’s more than the entire crypto market today... by multiples.

That’s why some of the biggest names in finance and tech are already sounding the alarm...

Federal Reserve Governor Christopher Waller, who is favorite to be the next Fed chair, called stablecoins...

“The highest-profile example of a new and fast-growing payments technology.”

That’s not a tech bro talking.

It’s one of the most respected names in American finance.

And he’s not warning people about crypto.

He’s preparing them for it

Inside the crypto industry, there’s even more excitement...

Brian Armstrong, CEO of Coinbase, reported from The World Economic Forum in Davos that...

Crypto and AI were the most discussed topics...

Major market leaders were focused on President Trump’s Strategic Bitcoin Reserve – and how they can avoid being left behind.

Corporate leaders – banks, assets managers, payment services firms made clear they were all accelerating investments in crypto.

And right now is where the next wave of generational wealth gets made.

Alright Robert... I’ve got to tell you...

Everything you’ve laid out so far makes perfect sense to me, and I’m sure it does to our viewers.

But here’s where I think a lot of viewers... including me... start to get a little stuck...

We know the legislation is coming, right?

We’ve seen the proof Big Tech is ready...

We know President Trump, his family and many, many in Washington are all in...

But let’s be real... there are thousands of coins out there.

I’m just gonna say it. I think most of them are junk.

How do we decide which crypto to buy?

That’s the key question, Shah.

And you’re right... Not every crypto gets lifted by this wave. Crypto is still a volatile market.

There’s risk in every kind of investing, and you should never invest more than you can afford to lose.

But whenever we get a catalyst this big... whether it’s smart contracts going mainstream, or DeFi protocols launching... only a few projects actually capture that upside.

I'm convinced personally that when institutional money flows in, and I know this for a fact, huge gains are inevitable.

But how do YOU separate the winners from the losers, Robert?

Over the years, I’ve developed a simple approach to spot the crypto plays with the most explosive profit potential before they take off.

I call it the H.U.N.T. strategy.

Hunt as in H.U.N.T.?

H-U-N-T.

Not every pick draws from this exact strategy, but hitting all four markers is the goal.

H stands for Hot Stories.

I follow narratives all the time. What do YOU mean by that when you’re talking about narratives?

Shah, crypto moves on stories. Big stories that get everyone excited.

AI taking over. Government finally regulating stablecoins. Real companies tokenizing their assets.

I know you know this better than most Shah, but when Wall Street starts talking about these themes, that’s when the money floods in...

I get it. But please give us an example.

SPX6900... it has a simple story. “What if crypto met the S&P500?” It rode the narrative and delivered a 7,388% gain in a year.

That turns $1,000 into $73,000.

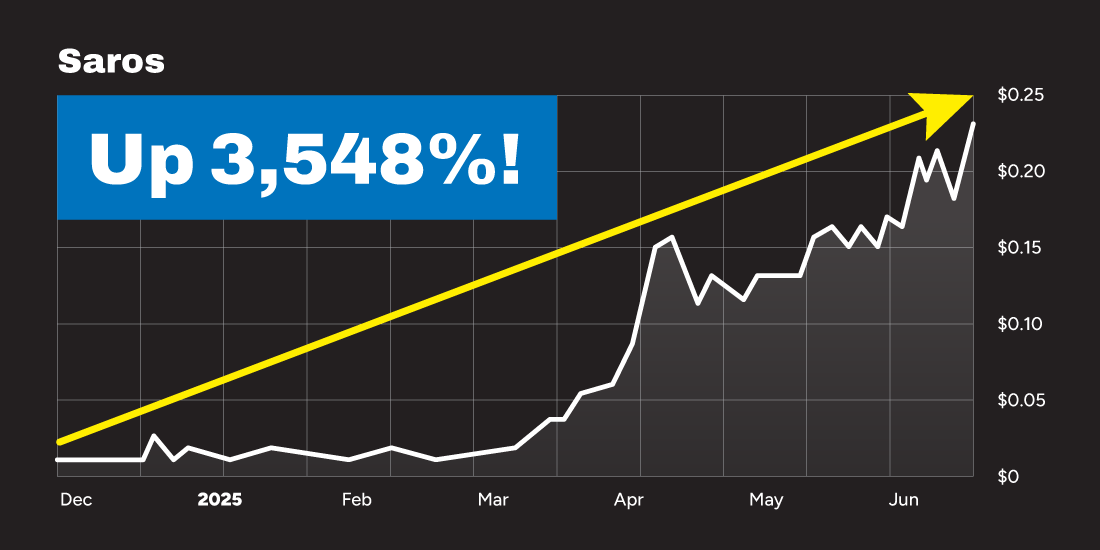

Or go look at Saros... The story was “The next big thing on Solana” ... It shot up 3,548% since December.

That turns $1,000 into $35,000.

Those are just two of the best examples though...

Shah, that's kinda the point. These aren’t rare. There are dozens of these types of opportunities every year.

Cheems Token: Up 253% since January.

You had tao.bot – it went from 4 cents to 82 cents in 2 months: a 2,000% gain.

NexusMind was up 616% in six months.

These are just some of the peak gains to help illustrate my point. Hot stories create hot gains.

So you're following the narratives, the institutional themes, right?

Exactly.

What's the U in HUNT?

U is for Unknown.

Everyone chases Bitcoin and Ethereum. The coins that everyone talks about on CNBC.

But many of the explosive gains come from the coins nobody’s heard of yet.

New altcoins, new chains, overlooked layer-1s... they outperform legacy coins from past cycles.

OK, I’m sorry, why is that?

Because fresh projects attract fresh money.

When something new solves a real problem, that's when you can see the explosive moves.

OK. Give us an example of that, please.

Acet. Nobody knew about it. Solved real DeFi problems. Saw peak gains of over 5,000% when it spiked from 1-and-a-half cents to 60 cents between February and November of last year...

Ski Mask Dog, ever hear of that one?

No. Crazy names, by the way.

Brand-new meme... it shot up to a peak of 1,500% in just a few weeks.

Zano. A new privacy coin. Saw peaks around 643% in six months.

These aren't household names, Robert...

Exactly!

When you find an unknown like this, life-changing gains are possible.

All right. I believe you. I know you’re right. And the N?

OK, the N in HUNT, it stands for NUMBERS...

That’s the price action...

Is there some kind of confirmation you look for?

Yeah, so I want to see the price already moving up with smart money behind it.

I want coins that have already started moving with strong relative volume.

This is the market telling you who the leaders are.

That seems a little backward. Shouldn't you buy before they start moving?

That's what most people think. But strength during market stress is a signal, not a risk.

Why is that?

Because it shows institutional money is already flowing into that token. When a coin holds up during crashes, like we saw recently, that tells me smart money is accumulating.

I mean, Look at XRP... even with all its regulatory battles, it still delivered 377% gains since July last year because institutions kept accumulating.

Then you had Bitget Token show consistent strength and deliver 366% gains over that same period.

And Sui maintained its technical momentum for a 328% gain.

So these aren't just lucky picks, obviously? There’s a lot more to it.

They are great examples, to be sure. But there are dozens more examples just like them. And numeric confirmation, or the numbers, show institutional interest before the explosive moves.

Okay I get it. And the T?

The T in HUNT stands for Thick Volume.

When trading volume surges, whales are moving. Big money is confirming the move.

How do you track that?

I monitor whale transactions over $1 million. When these spike, it means big money is confirming the breakout.

It tells me it's not just retail noise... it's institutional validation.

All right then. Can you give us some recent examples, please?

KOGE had massive volume spikes before its 225% gain in 2024.

WhiteBIT Coin showed thick institutional volume before delivering 218% for the year.

Tornado Cash, despite the controversy, had whale accumulation before its 205% move in 2024.

So this is following numbers... Following whales... You’re following the whale money.

Yep, exactly. And Shah, these are just some of the examples from some of the top 20 gainers over the past year. But there are literally hundreds more. Take a look at some of the best just since last July.

XPR Network: 197% gains. SpaceN: 194% gains. SWFTCOIN: 189% gains.

The opportunities are literally overwhelming if you have a strategy to identify them.

All of them followed the H.U.N.T. pattern?

Of course.

So all four have to line up?

When you have a Hot story...

An Unknown crypto that solves REAL problems, but hasn’t been bid up yet...

The NUMBERS show institutional buying...

And then, what I think is the most important part, Thick volume: Whale transactions confirming the breakout. Confirming that THEY wanna be involved in these tokens as well.

That’s when I personally get excited.

It sounds like, looks like, these ALL work together, yes?

They create a complete picture.

But I also look at the fundamentals behind each coin.

Explain the fundamentals of coins for us, please...

So the foundation of any good altcoin investment is its underlying use case.

Does it solve real-world problems? Does it have a unique value proposition?

Like what?

Facilitating faster transactions, developing decentralized storage, handling cross-border payments, supporting smart contracts.

The coin should have a clear and viable purpose.

You’re talking about the projects behind these coins right. Now I get it. I get it.

What else do you look for?

What about other market factors?

So I always look for market liquidity. High liquidity ensures you can buy or sell without causing major price swings.

And I check trading volume on various exchanges to gauge liquidity.

So it's not just about the technology?

No, you need the technology, community, market dynamics, institutional flows – they all have to align.

And when they do, sir?

That's when you get the explosive moves.

And Shah, here's what most people don't realize – these opportunities happen all the time.

What do you mean?

This year alone, there have been hundreds of coins delivering 200%+ gains. Dozens delivering 500%+ gains. Multiple coins delivering 1,000%+ gains. Often in a matter of just months to a year.

So you think you've found another one?

Using the H.U.N.T. strategy...

I've identified what I believe is the next major institutional play.

And what makes you so confident on this one?

All four signals are flashing green right now.

Hot narrative: Stablecoin regulation and Big Tech integration.

It’s a blockchain that can handle the institutional volume that's coming.

Then we have the Numbers: Strong technicals showing institutional accumulation.

Again, most importantly, we have that Thick volume: Whale accumulation patterns I've seen before major breakouts.

I especially like that whale accumulation.

So, in my book, that’s not speculation, is it?

This is pattern recognition.

Same patterns you could have used to spot SPX6900 before it spiked 7,388% in a year...

Same patterns you could have used to find Saros before it delivered 3,548% gains in 6 months...

And the timing?

The smart money is positioning now.

And in just a moment, Robert is going to share the name and ticker and all the details on the coin with us.

So, tough question – is the window is closing?

These setups don't last forever.

When institutional money starts flowing, you either move with it or you miss it.

And our time to move is now...

In my 40-plus years on Wall Street, I’ve never seen a setup quite like this.

A sitting president with his entire inner circle deeply invested in crypto... WOW...

A bipartisan regulatory breakthrough that could be signed any day... holy mackeral...

And, most stunning to me, $540 trillion in institutional assets on the verge of flowing through this new system.

This kind of moment? It doesn’t come around often. Or maybe ever.

So what would you say to a beginner who’s watching...

Someone with no crypto experience... And perhaps not a lot of trading experience... maybe a small bankroll... They may be wondering, is this really something they could do? Do they need experience to get in on this Robert?

Honestly, all the talent you need is the ability to think things through for yourself and then follow simple instructions.

If you can CLICK open an email... READ my research and COPY my trades... you can potentially PROFIT.

I have to admit, I’ve always liked the idea of copying the homework answers from the smartest kid in class!

So what would you say to someone who might be worried they need a bunch of “capital” to get started?

Of course, the higher the stake, the higher the potential rewards. But also the higher the potential losses. You should never invest more than you can afford to lose.

But you can get started with just a couple of hundred dollars. And because of the volatility in crypto, over the next 6 to 12 months you can potentially target moonshots up to tens of thousands of dollars. Snowball your profits. Take your original stake off the table. And play just with house money.

Of course, there’s no guarantee.

We do have to expect some losses along the way...

That said, I believe the winners can more than make up for them...

And even if I’m completely wrong, following my strategy, your risk can be limited, so you should never risk a penny more than you’re willing to lose...

This is the beginning of one of the biggest shifts in monetary history.

And I believe the profits we’ve seen so far are just a shadow of even bigger things to come.

And that’s why we’re here today.

Robert is so dead on. This is THE biggest shift in monetary history. This is the making of monetary history.

Frankly, if I were watching at home right now, I’d want Robert by my side to help me navigate this opportunity

And by the way, you’re going to be by my side.

What Robert has shown you today is different.

You've seen the Trump legislation timeline... the institutional money waiting... and most importantly, you've seen how simple this actually is.

Just take a look at what Robert showed us today.

This isn't about chasing meme coins or complex DeFi strategies.

This is about positioning yourself ahead of the biggest regulatory shift in crypto history... and doing it as simply as buying a stock.

But listen, this type of investing is not right for everyone.

It may not be right for you.

Crypto can be highly volatile.

In order to participate, at the minimum you probably need to risk a whole $100 per trade.

But here's what I love about Robert's approach... it's designed for people exactly like you.

And the way these trades can soar, even small investors with modest portfolios could see a shot at very large returns.

However, it’s still important to use risk management tools such as stop-loss orders to protect your account.

Listen... I have been very impressed with everything Robert’s doing...

And that’s why I’m here today...

I worked out a deal to have Robert open up his research service for the first time at this price this year to all my followers...

So you’ll have the opportunity to get your name on Robert’s private email list... right next to mine...

And if you want to be among the first to get your hands on Robert’s step by step blueprint on what to do IMMEDIATELY after this call, to make sure you don’t miss a thing, let me explain what to do...

It couldn’t be simpler for you to get started.

Robert?

Starting today... to give you access to all my trades and analysis going forward...

We’re opening the doors to my research service, Breakout Fortunes.

That’s the good news.

Here's the reality...

Breakout Fortunes normally runs $4,000 a year.

Now that may sound like a lot of money... but let me be very clear with you. Our publisher should be charging a lot more.

Because based on this new cryptocurrency law alone – she could easily charge $10,000 or more for this research... and smart people would line up, trust me.

The good news is... because you’re here and because you’re watching me right now... you’re receiving an incredible limited-time invitation...

Please note: This invitation could be pulled offline without notice. Because Trump could sign this legislation tomorrow... literally tomorrow... and when that happens, the early positioning advantage disappears.

So you need to act to claim this offer immediately.

Here's what you need to know...

Respond right now, and you'll get one full year of Breakout Fortunes for just $1,495...

That saves you $2,500 right up front...

Meaning you’re effectively paying just $4 a day for research with the potential to help you learn how to cash in on what could be the biggest crypto adoption wave in history...

And Robert is going to show you the exact moves to make every step of the way...

Starting with his first urgent briefing: “The Trump Crypto Blueprint: How To Build Your Own Private Strategic Crypto Reserve Like America’s First Family of Crypto”...

This is Robert’s blueprint for mirroring the Trump family’s personal strategy, including the core altcoins he believes are set to skyrocket on the back of this new law...

These are the foundational holdings Robert believes every investor should have to build generational wealth in this new digital economy.

Next up, you’ll get Robert’s special report called “Crypto Mania Moonshots: Five Coins Under $5 That Could Return 100X Or More Over the Next 12 Months”... as this situation plays out...

These are Robert’s highest conviction small-cap crypto picks... With the potential to return 10X, 20X, even 50X or more over the next six months to a year. To be clear – these are moonshots. Some of them WON’T work out. Some of them may go to zero.

But if just one winner works out the way Robert believes they could, it might make up for the losers and then some, many times over.

Just click the button to get started now and you’ll see all the details on the next page...

Want to know why I think you should take a look at this?

Robert said to me privately before we sat down today...

“Shah, he said, this is not the Holy Grail. We will have winners and we will have losers. And I want to make sure we clearly discuss the risks as well as the potential rewards.”

Cool. I don’t need to tell you... There are a lot of other people out there who might take a different path...

They might promise you a 99.9% win rate... Or that they could show you how to turn $100 into a million overnight.

Whatever...

Instead Robert came here simply to present the facts, and to tell us about the risks as well as the potential rewards.

That kind of honesty in crypto is incredibly rare.

And I can tell you, on Wall Street it’s almost unheard of.

It shows me that Robert is unlike almost anybody else in the crypto universe you’ll ever meet in this space.

It’s one of the many reasons why I like him so much and why I personally decided to work with him, and am here putting my reputation on the line to share this with you guys... and I do it willingly and gladly.

The exciting part here is, you know, we’re in a place now where stock and bond markets seem to change almost hourly...

Well... Here’s something where you can risk just a small amount of money... and potentially create some extremely profitable trades.

That’s why I’m here interviewing Robert and sharing this opportunity with you.

Because this strategy ought to be part of our trading system.

It’s a good fit.

And that’s also why I’ve decided to go out on a limb and add something extra...

Look, I think you’ll agree...

$1,495 to get access Robert’s Breakout Fortunes research service is AWESOME...

But I want to go one better...

As a bonus... to thank you for becoming the newest member of Breakout Fortunes... I asked my publisher to back it with a 1,000% performance guarantee.

Here’s how it works...

If over the next year, at least one of the recommendations in Robert’s portfolio doesn’t give you the opportunity to see a return of 1,000% – just call up my team to claim a second year free.

That's right – if you don't see the chance to 10X your money on at least one pick, you get another full year of Breakout Fortunes at no charge.

Keep in mind, Robert hasn’t seen a gain like that yet, it would be the largest in his model portfolio to date.

But he’s so confident, our publisher is willing to stand behind him and back him 100%.

Because this event is so historic, this is the best offer my publisher has ever made...

And I can tell ya...

If you like my work... if you like my research... if you’re always looking for quality research... I really think you’re going to LOVE your membership to Breakout Fortunes...

Robert, can you explain a little bit about how the service will work?

Given the crypto market is OPEN 24 hours, 7 days a week... are people going to need to be on alert all the time? Will you be sending trade alerts at 2 a.m.? 8 p.m.?

While I think it’s great crypto is open 24/7, I don’t want subscribers anxiously waiting, thinking they’re going to miss a trade alert.

Also for my own sanity here, I don’t want to be trading at 3 a.m. every night, trying to find a good setup for people.

So my philosophy is if I see a good setup at 8 p.m., and you know – it goes out of range overnight – there’s always going to be another trade.

OK, so you’re not going to force it.

And I think that’s really smart.

So will you send regular updates and regular issues to bring readers up to date on the existing positions?

Of course, Shah. We will send updates on what to buy and sell.

And it’s not just crypto . You will also receive stock and options trades. Wherever I find highest reward opportunities.

With crypto, it’s not like buying stocks or other investments where you’re expected to tie up your money for months, or sometimes even years.

I send you an email... And it tells you everything you need to know to get in, get out, and get paid.

And I want you all to think about this...

After a couple of successful trades you can pull out your original stake, and play with house money...

Imagine never having to risk your principal again.

With just a few hundred dollars, you could be making thousands, within 6 to 12 months...

You saw the examples before...

Those gains can come FAST...

And as you take those gains off the table... without putting too much of your money at risk – you’re only playing with house money.

This could be perfect for you.

Because stock and bond markets have been all over the place. Often times, when those markets are going through all this turbulence, the crypto market is the place where you can find the biggest returns...

Still, I realize for some people this is probably not a good fit, and I get that.

I understand this is only going to appeal to maybe a small number of people that can really understand the power of being able to rely on Robert’s trading strategy for the chance to target massive profits from tiny crypto currencies.

And I’m here to tell you... this small group of people who decide to take action on this today I believe could do VERY well by this time next year.

And by the second or third winning trade, you may even be able to pull all of your money out, and just play with house money going forward.

Now, I don’t want to rush you.

However, my publisher plans to pull this offline the moment President Trump signs the bill.

That could happen any time. It could happen tomorrow!

After that, you may never have another chance to get in at these terms again.

So if you want to join Robert at possibly the lowest price we will ever offer Breakout Fortunes...

If you want the 1,000% performance guarantee...

This might be your one and only shot.

I don’t want to disappoint you. So please place your order immediately to ensure you don’t miss out.

If you are a follower of mine... if you have benefitted from the research I’ve shared with you in, in any way... let me let you in on a little secret...

You are already benefitting from Robert’s work!

Robert and I talk regularly about what’s going on in the market. His opinions. My opinions. We see where we come together, where we differ on things...

It doesn’t happen that often.

His research and analysis are vital in almost every issue and update I send you.

Now, you have the chance to see Robert showing you what HE does best – and giving you all the tools and knowledge you need to profit from these tiny cryptocurrencies... the way he has, for himself and his clients, his entire career...

And I urge you to come join me in this service immediately.

Get this research and these trades for yourself.

Because this is a once-in-a-generation opportunity!

But if you’re thinking, “Well, gee, Shah, that sounds great, but I don’t really want to buy another expensive service right now.” I have good news and bad news for you.

I can only guarantee your spot if you take action now...

If you hesitate, it may be too late.

And what does it come down to?

$4 a day... Coffee money.

Just click the button on this page to claim your spot and get started now.

Now Robert... perhaps some people are wondering, What if they don’t have trading experience. Is this something they could even try?

Well Shah, that’s the cool thing. You don’t need an advanced understanding of trading to follow these recommendations.

My team and I’ve created a collection of short cryptocurrency trading guides to walk you through my strategy, and show you how to place your first trades, and manage your risks.

In my mind, whenever I’m making a recommendation or communicating with someone about the market, I always imagine I’m talking to my mom.

So the recommendations I share with you in these reports, and will share with you in all future issues and updates, are the same as I would give to somebody very close to me.

On a personal level, that’s very important to me. Because I do believe Breakout Fortunes can truly help people.

And part of that is teaching people on how to use position sizing and risk management... to ensure you’re making smart moves... and taking as much potential risk out of the trades as possible.

As you’ve already seen, the types of trades we’re going to recommend to you can be completed by anyone.

Once you get familiar with placing crypto trades, you’ll see they’re as simple as buying and selling a stock.

And I just want to point something out.

My Membership Services team is at your disposal. They are going to provide resources for you that will walk you through every step of the way showing you exactly what to do with your subscription, telling you exactly what to click so you can learn how to place as many of these trade recommendations as you wish.

Just click the button to get started now and you’ll see all the details on the next page...

This isn’t about chasing the next meme coin, people!

This is about positioning ahead of the biggest adoption wave in financial history.

And fortunately, you can have Robert by your side... every step of the way.

I want to ask you some more questions Robert.

And of course, you have the free recommendation you’re going to share with everyone.

But before we get to that, if you don’t mind, can you answer the most important question I think people might want to ask. Like...

“What do I do now to make sure I don’t miss out on this opportunity?”

Because there is SUCH a time-limited window on this.

It's so time-sensitive.

So please tell people what to do right now.

Not a problem.

So when you join Breakout Fortunes, you’ll immediately get three reports walking you through the exact cryptocurrency plays to buy now – and how to buy them.

If you place your order now, you could own them all within five minutes if you’re already set up to trade...

And if not, we can set you up tonight, so you’re ready to place your trades first thing tomorrow morning.

You’ll get my top altcoin plays.

My step-by-step strategy to go after 10X... 50X... even 100X opportunities over the coming year.

And my risk management toolkit will give you the ability to risk a little... to potentially make a lot.

Now, normally, Breakout Fortunes is only offered at this price during a special event like this once or twice a year.

And this is the first time this year we’re opening the doors on it.

And given the limited-time nature of this opportunity, given Trump could sign this new stablecoin legislation at any moment, it may not remain open for long.

Remember: It comes with this guarantee...

The one year 1,000% performance guarantee. If you don’t see the opportunity to make 10X or more over the next year, you get a second year free – or a year of any other service we offer.

Keep in mind, this would be the largest gain in our Breakout Fortunes model portfolio to date. But we’re willing to back it with this 1,000% performance guarantee because that’s how confident I am in this historic wealth-building opportunity.

But the clock is ticking.

The summer break for Congress is fast approaching – and any day now the president could sign this into law.

And when that happens? The institutions will move. The early positioning advantage disappears.

If you want in, now is the time.

Click the button on your screen, secure your discount, and get everything we’ve talked about tonight.

Look... if you’ve ever said to yourself, “I wish I’d bought Bitcoin when it was $200...”

I know I’ve said it a thousand times!

This is your moment.

But it won’t last.

I believe we’re on the verge of an historic change in the financial world... and potentially the mass adoption of cryptocurrencies...

Something like this may only happen once in our lifetime, and this time, you don’t have to watch from the sidelines.

Click the button. Get the details now. And I predict a year from now you’ll be very happy.

Alright, Robert... we’ve covered a lot tonight. And I know for many folks watching, this feels like a brand-new world.

Crypto’s moving fast. The legislation is real. The opportunity is real.

But I know there’s one question above all right now that folks want to ask... I know I do... tell us...

What is the coin you recommend we all buy?

So the project I believe is most directly aligned with this shift... in terms of scalability, compliance, and adoption readiness... is Cardano (ADA).

Ah! Cardano? That’s a name people have heard before... but it’s been rather quiet lately, hasn’t it?

Yeah, but that’s what makes it so powerful.

Cardano is the sleeper.

It’s been battle-tested. It hasn’t had its “ETF moment” yet. It hasn’t spiked. It’s still undervalued.

But it’s sitting right in the sweet spot... where fundamentals are strong, and visibility is still low.

So we’re talking about a real infrastructure play and a classic “undervalued” play?

Exactly.

Everyone’s looking at Bitcoin and Ethereum...

Meanwhile, Cardano is building quietly and waiting for the regulatory floodgates to open.

And when they do?

It’s one of the few networks capable of handling the demand.

And that’s why it’s one of my top picks for this moment.

Oh, I like buying stuff on the cheap. But you said, one of?

That's right, Shah. Cardano is my foundational play... solid, battle-tested, ready for institutional adoption.

But using the H.U.N.T. strategy, I've identified opportunities that could be even bigger.

You just made a pretty compelling case for Cardano. How much bigger could these others be?

Think about it like this... Cardano is like buying Apple stock in 2010. Solid company, proven technology, great long-term prospects.

But the explosive gains? Those come from finding the companies that Apple partners with. The

infrastructure plays. The picks-and-shovels opportunities.

Picks and shovels, I get it. But for our viewers, what do you mean?

When stablecoin legislation passes, it won't just benefit the major blockchains like Cardano.

It'll create an entire ecosystem of opportunities.

Like what?

Payment processors that handle stablecoin transactions.

Cross-border settlement networks that institutions will need.

Compliance and custody solutions that banks will require.

DeFi protocols that will power the new financial infrastructure.

So you're saying the supporting infrastructure – which obviously includes Cardano – could be bigger than the main platforms?

Exactly. When the internet exploded, Amazon and Google did well.

But the companies that built the fiber optic cables, the data centers, the payment systems... some of those delivered even bigger returns.

And you think the same thing will happen with crypto?

I know it will. Because I've seen this pattern before.

When Bitcoin ETFs were approved, Bitcoin went up 294% in just 587 days. Great returns.

So what kind of opportunities are you looking at?

Mostly Layer-2 scaling solutions that will handle the transaction volume.

You want Interoperability protocols that will connect different blockchains.

Institutional-grade custody and compliance platforms.

Real-world asset tokenization projects.

And that’s why you want Robert by your side folks. Because HE UNDERSTANDS WHAT ALL THAT MEANS! And can break it down for you into simple recommendations...

And Robert – as important as all those things are to the financial system... Especially this new financial system... Could some of these be a LOT bigger than Cardano?

Shah, Cardano might give you 5X to 10X returns over the next year.

But some of these infrastructure plays? We're talking about targeting 20X, 50X, even 100X potential. And if the past is any guide, you could be looking at them within the next 6 to 12 months.

Why such a big difference?

Market cap and adoption curve.

Cardano is already a 15 billion project. For it to 10X, it needs to reach 150 billion.

So you're looking for smaller projects with bigger upside?

I'm looking for projects that will become indispensable when trillions of dollars start flowing through crypto rails.

And you think you've found them?

Using the H.U.N.T. strategy, I've already identified several opportunities that check all the boxes.

So Cardano is just the beginning?

Cardano is your foundation. Solid, reliable, institutional-grade.

Yeah, and you said it could 5X and 10X as soon as this year... I sure like that

And who wouldn’t like that? But the explosive gains will come from the infrastructure that makes institutional crypto adoption possible.

And that's what you cover in Breakout Fortunes?

That's exactly what you get. The full ecosystem play.

Not just Layer 1 winners like Cardano... But the hidden infrastructure opportunities that could deliver a shot at life-changing returns.

How many opportunities are we talking about, Robert?

In the reports you'll receive, I break down my top 10 plays for this institutional adoption wave.

Cardano is your anchor position.

But the other four? Those are where the real explosive potential lies.

And you think all of this happens in the next year? Sooner?

Shah, when Trump signs that legislation, my feeling is that it's not going to be a gradual rollout.

Apple, Google, Meta, Microsoft... they've already built the infrastructure. They're ready to flip the switch right now.

When 3 billion people suddenly have access to stablecoins through their existing apps...

When trillions of dollars need new rails to flow through...

The infrastructure that supports that transformation won't just grow. It'll explode.

So yes of course, as always the timing is critical?

The window to get in early is closing fast.

Once institutions start deploying capital, these opportunities won't be hidden anymore.

You either position yourself now, with the smart money, or you watch from the sidelines as others capture the gains.

Everything you’ve said makes perfect sense to me.

You’ve shown the policy shift... which everyone should see... the tech infrastructure... the institutional money... and a credible asset at the center of it all.

But here’s what I know a lot of our viewers are likely thinking:

“I’m not 25. I’m not a day trader. I’m not looking to YOLO into altcoins and hope for the best.”

So let me ask you directly: on their behalf, and mine too – because I’m not 25:

Do people need to take big risks to benefit from this?

I understand people’s apprehension to this, Shah. And it’s a great question, Shah. And the answer is no.

In fact, I believe this setup is perfect for the cautious, conservative, risk-averse investor... as long as they act before the framework hits.

Let me show you why.

Let’s say you put just $500 into Cardano.

No leverage. No fancy trading.

Just a simple early position... before the legislation passes.

Now, if Cardano simply closes the valuation gap with Ethereum... which would make sense... THE FOUNDER OF CARDANO WAS ONE OF THE KEY MEMBERS OF THE ORIGINAL ETHEREUM TEAM...

It’s not crazy, considering it’s one of the only scalable DeFi chains left... you’re looking at a shot at:

$500 into $6,000.

That’s a 12x target... potentially in the next 6-12 months without needing the coin to become dominant, without hype, without media attention.

And that’s before factoring in Big Tech wallet adoption, stablecoin integrations, or institutional inflows.

You’re saying the math already works... just based on the fundamentals, correct?

That’s right.

And the best part?

Even if you only hit a 3x or a 5x, you’re in position to do something that most investors only dream about:

Pull your original capital off the table... and ride the rest with house money.

Low stress. No pressure. And zero emotional strain.

Gotta love playing with house money. So this isn’t about gambling. Which a lot of folks equate to cryptos.

It’s not a Hail Mary.

It’s a rare window of time where even small positions can punch way above their weight... and you can see the chance to make a bunch of money without risking the farm, I get that.

Exactly. You don’t need to swing for the fences.

You just need to step up to the plate while the bases are loaded.

“What if there's a crypto market crash? Will these recommendations still work?”

All investments carry risk, and crypto can be volatile.

But here's the thing – we're positioning ahead of the biggest regulatory shift in crypto history. When institutions start deploying capital, that creates a floor under quality projects like Cardano.

Plus, if there is a downturn, it's actually a buying opportunity. A chance to load up on the projects that will benefit most from institutional adoption.

“How often will you send recommendations?”

I can't say we'll get two trades a month like clockwork. Maybe some months we'll get five trades, maybe some months just one.

A lot of times they come in clusters, especially around major regulatory developments.

But that's the way you want it. You don't want me sending recommendations just for the sake of sending a recommendation.

We'll play the market as it comes, and based on this legislative opportunity, I expect we'll have plenty of actionable ideas.

How much should people allocate to this?

I personally dedicate 5% of my portfolio to these “moonshot” investments.

Sounds small.